When you hear about billionaires like Mark Zuckerberg or Jay-Z taking out mortgages on homes they could easily buy outright, it might seem puzzling. After all, with their wealth, why not just pay cash? The truth is, these financial heavyweights often use mortgages as strategic tools to enhance their financial flexibility and growth. Here’s why that strategy makes sense — even when you have more money than you could ever spend.

Keeping Cash Flow Flexible

Maintaining liquidity is a top priority for the ultra-wealthy. By opting for a mortgage instead of tying up a significant portion of their wealth in a property, they keep their cash free for other ventures. This could include investing in startups, funding new projects, or seizing timely market opportunities.

It’s not about whether they can afford the house — it’s about keeping their capital agile and ready. For people with access to multimillion-dollar deals and fast-moving markets, sitting on a $20 million property paid in full is a poor use of capital.

Source: Enness Global

Investing at Higher Returns

Many wealthy individuals borrow against their real estate because they believe they can generate a higher return elsewhere. If they lock in a mortgage at 3% interest and expect their investment portfolio to earn 7% annually, that 4% spread adds up significantly over time — especially when dealing with millions.

This isn’t theoretical. It’s the kind of basic capital allocation decision that helps rich people stay rich. While most people view mortgage debt as something to get rid of, the ultra-wealthy often view it as a tool to amplify long-term returns.

Source: Motley Fool

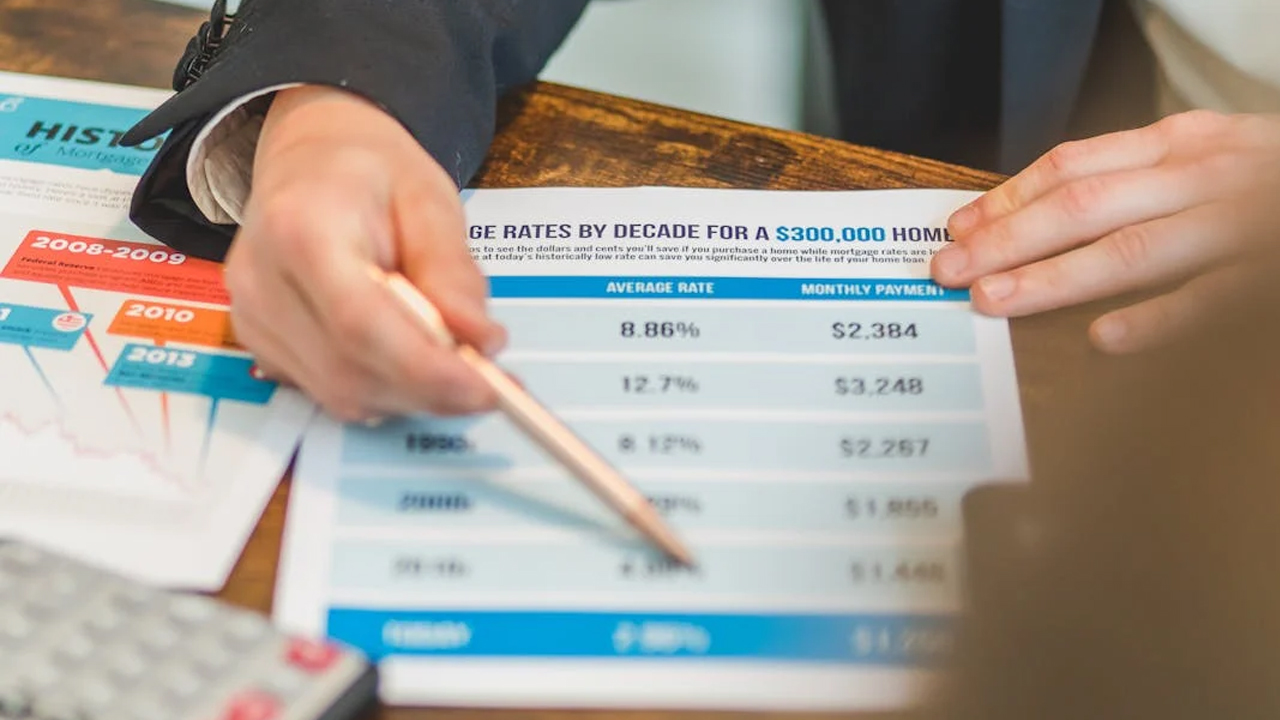

Taking Advantage of Low Interest Rates

Billionaires also tend to have access to extremely favorable lending terms. Back in 2012, Mark Zuckerberg reportedly got a 30-year mortgage at just over 1% interest. With borrowing that cheap, there’s almost no reason to drain cash to buy a home outright.

When loans are that inexpensive, it’s often smarter to borrow and keep your money working elsewhere. It’s a subtle reminder that the financial system isn’t the same for everyone — and those with excellent credit, large assets, and financial know-how are playing a very different game.

Source: Christian Science Monitor

Tax Benefits

Mortgages can come with tax advantages. In the U.S., mortgage interest can often be deducted from taxable income — especially on primary homes up to a certain limit. For ultra-high earners, this deduction can soften the cost of carrying a mortgage.

While the 2017 Tax Cuts and Jobs Act reduced the cap on deductible mortgage interest to $750,000 for new loans, that still covers a meaningful chunk. And in some cases, mortgage interest on second homes or investment properties may still be deductible depending on how they’re structured.

Hedging Against Inflation

A fixed-rate mortgage gives high-net-worth borrowers a long-term hedge against inflation. If you borrow $5 million today and inflation rises over the next 10 years, the real value of that $5 million loan shrinks. Meanwhile, your assets — including the property — likely increase in nominal value.

In essence, they’re paying back the loan with “cheaper” dollars over time. That’s one reason some see long-term fixed-rate debt as smart — especially in low-interest environments where inflation eats away at money’s real value over time.

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.