Coin collecting sounds like a fast track to millions, but it’s not about instant cash—it’s a slow build. Beginners often jump in expecting quick profits, only to find it’s more about patience and smarts. For finance-minded folks like you, here’s how to start right, avoid pitfalls, and maybe turn a hobby into something profitable down the road.

Start Small and Learn the Basics

Don’t drop big money on rare coins right away—begin with what’s affordable, like circulated quarters or pennies. Get a feel for mint marks, years, and conditions; those details matter more than you think.

Books like the Red Book—around $15—teach you what’s valuable. A $5 lot could grow to $50 over years if you pick smart. Take it slow; rushing burns cash without building know-how. (Source: American Numismatic Association)

Focus on Condition, Not Just Rarity

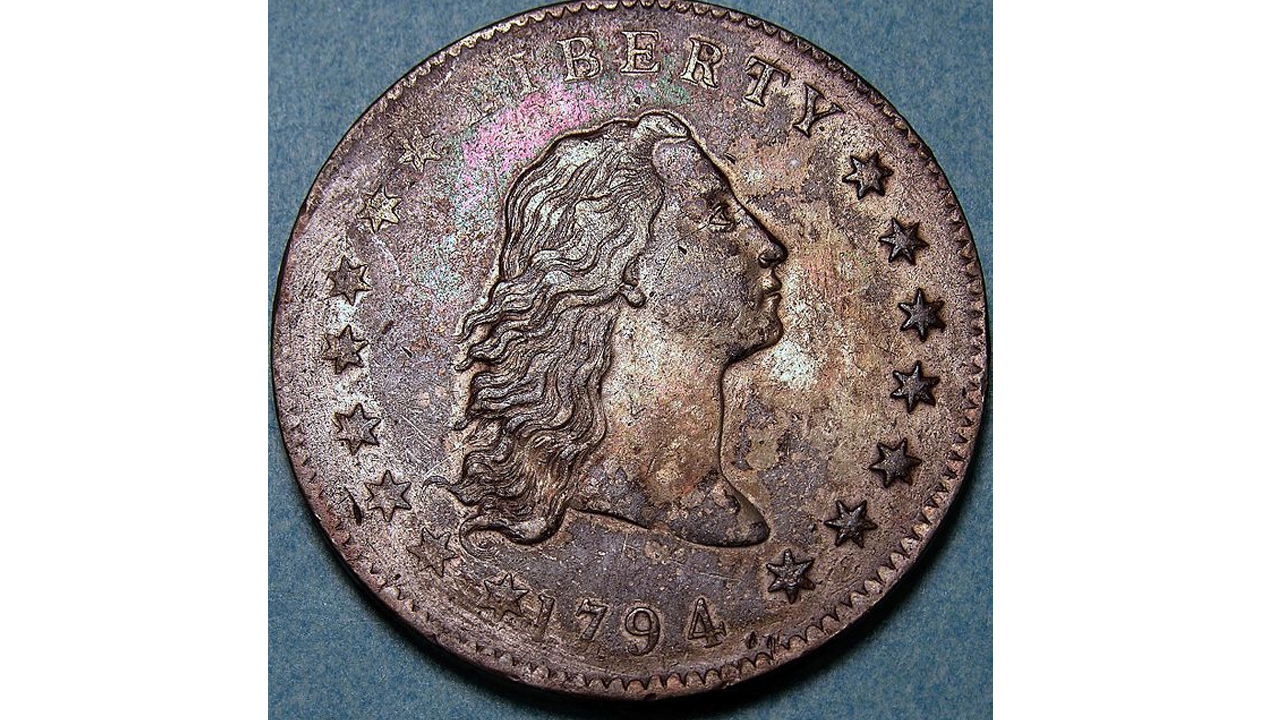

A beat-up 1916-D Mercury dime might fetch $500, but a pristine one hits $50,000. Condition—graded from Poor to Mint State—often trumps rarity for value. Learn to spot wear or shine.

Use a magnifying glass to check edges and surfaces. A $10 coin in top shape could outpace a $100 rarity that’s scratched. Patience here pays; quality beats hype every time. (Source: PCGS CoinFacts)

Research Before You Buy

Coins like the 1969-S doubled-die penny can hit $35,000, but fakes are everywhere. Dig into auction records or price guides—don’t trust a seller’s word. Knowledge keeps you from overpaying.

Sites like PCGS offer free data on past sales. A $20 purchase could turn $200 with research, or flop if you skip it. Smart moves now mean real gains later. (Source: U.S. Mint)

Build a Network, Not Just a Collection

Local coin clubs or online forums connect you to folks who’ve been at this for decades. They’ll tip you off to deals—like a $50 lot with a sleeper coin—before the market catches on.

Relationships beat solo hunting. A $100 investment might double through a club tip. Stick with it—trust and time turn small buys into steady growth. Collecting’s a marathon, not a sprint—start slow and watch it pay off.

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.