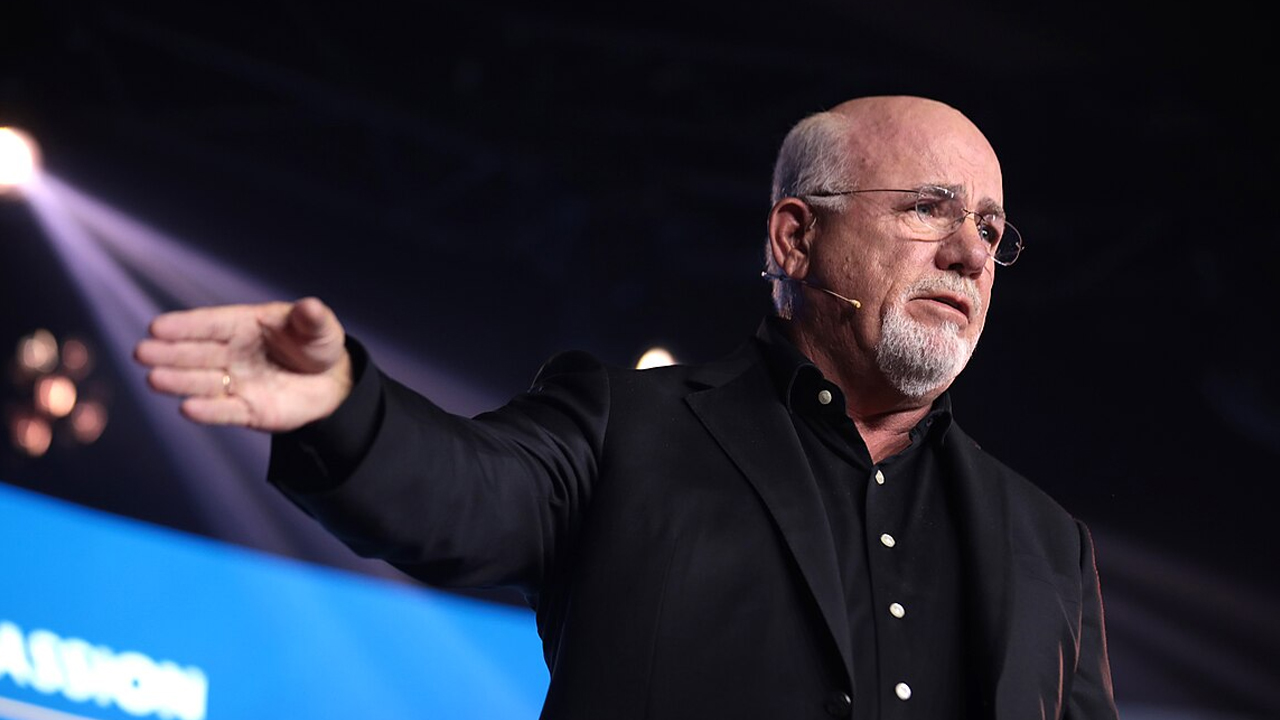

Buying a home is often one of the most significant financial decisions many will make in their lifetime. Dave Ramsey, a renowned financial expert, offers timeless advice on how to navigate this process prudently. Here are three essential rules from Ramsey that can help ensure you buy a home the right way.

The 25% Rule

One of the foundational principles Dave Ramsey advocates is the 25% Rule for budgeting your home purchase. This rule suggests allocating no more than 25% of your monthly take-home pay on housing costs, which include your mortgage, property taxes, and insurance. Sticking to this guideline helps maintain your financial stability and prevents you from becoming house poor, where a disproportionate amount of your income is consumed by housing expenses.

By keeping your housing costs under control, you can allocate more of your resources towards other financial goals such as savings and retirement. This disciplined approach to budgeting can significantly enhance your long-term financial health, ensuring that you are not overwhelmed by your housing costs and can comfortably manage other aspects of your financial life.

20% Down Payment

Dave Ramsey also emphasizes the importance of making a 20% down payment when buying a home. By doing so, you avoid paying private mortgage insurance (PMI), which can add significant costs to your monthly payments. Avoiding PMI is not just about saving money; it also means that a larger portion of your payment goes towards building equity in your home.

A substantial down payment provides a financial cushion and can lead to better loan terms. Building immediate equity in your home gives you more financial flexibility and stability. It also means that you’re less likely to be underwater on your mortgage if housing prices fluctuate, giving you peace of mind and increased security in your investment.

15-Year Fixed-Rate Mortgage

When it comes to choosing a mortgage, Ramsey strongly recommends opting for a 15-year fixed-rate mortgage. This type of mortgage generally offers lower interest rates and significantly reduces the amount of interest paid over the life of the loan compared to a 30-year mortgage. By choosing a shorter term, you not only save money on interest but also accelerate your path to full homeownership.

Paying off your mortgage in 15 years frees up money for other investments or financial goals. This strategy aligns with Ramsey’s philosophy of living a debt-free life and achieving financial freedom sooner. Although the monthly payments are higher, the long-term benefits of reduced interest and quicker equity accumulation make the 15-year mortgage an attractive option for those who can afford it.

Emergency Fund Preparedness

Before purchasing a home, it is crucial to have a fully funded emergency fund. Ramsey advises having a financial safety net of 3–6 months of expenses to cover unexpected costs. An emergency fund provides security and peace of mind, knowing you can handle unforeseen circumstances like job loss or major repairs without financial strain.

This financial buffer is essential for maintaining stability and ensuring that your home purchase does not become a financial burden. With an emergency fund in place, you can focus on enjoying your new home rather than worrying about how to manage unexpected expenses.

Considerations for First-Time Buyers

For first-time buyers, understanding market conditions and trends is crucial for making informed decisions. It’s important to educate yourself on the real estate market to ensure that you are buying at the right time and at a fair price. Additionally, working with trusted professionals who align with Ramsey’s principles can significantly enhance your home-buying experience.

Engaging with trustworthy real estate agents and financial advisors can provide valuable insights and guidance throughout the process. These professionals can help you navigate the complexities of buying a home and ensure that you are making decisions that align with your financial goals and values. By following these guidelines and leveraging expert advice, you can approach homeownership with confidence and clarity.

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.