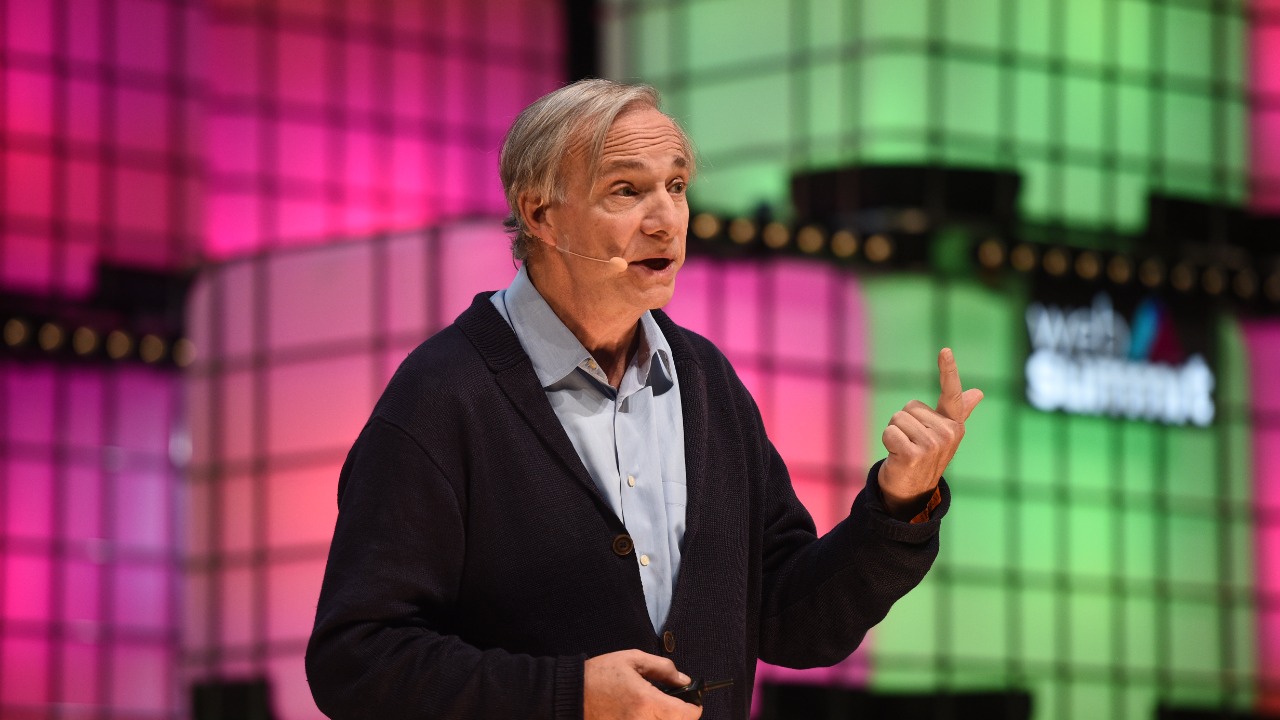

Ray Dalio, the renowned investor and founder of Bridgewater Associates, has mastered the art of predicting and navigating financial storms. With the global economy facing increased uncertainty, Dalio’s strategies for avoiding financial disaster are more pertinent than ever. His insights offer a roadmap for safeguarding against economic turmoil.

Understanding Economic Cycles

Economic cycles are an intrinsic part of how economies function, naturally rising and falling over time. Ray Dalio has long emphasized the importance of understanding these cycles to anticipate and prepare for potential financial disruptions. According to Dalio, recognizing the ebb and flow of economic activity can provide valuable foresight into when a downturn might occur.

Dalio keeps a keen eye on specific indicators that might signal an impending downturn. By monitoring factors such as interest rates, inflation, and debt levels, he can predict when financial disruptions are likely to occur. This proactive approach helps investors and policymakers alike to brace themselves for economic challenges and adjust their strategies accordingly.

Diversification as a Defense

One of the core tenets of Ray Dalio’s investment philosophy is the importance of asset diversification. By spreading investments across various asset classes, investors can mitigate risk and reduce the impact of any single asset’s poor performance. Diversification acts as a financial buffer, safeguarding portfolios against unforeseen market fluctuations.

Dalio also advocates for geographic diversification, investing in different global markets to minimize exposure to localized economic issues. This strategy not only broadens investment opportunities but also protects against country-specific risks, ensuring a more resilient portfolio in the face of regional economic instability.

Risk Management Techniques

Balancing risk and reward is a crucial aspect of Dalio’s investment approach. By carefully assessing potential gains against associated risks, he strives to achieve an optimal balance that maximizes returns while minimizing exposure to financial losses. This method involves a thorough analysis of market conditions, economic indicators, and potential outcomes.

Another key component of Dalio’s risk management strategy is the use of financial stress tests. These tests simulate worst-case scenarios, allowing investors to gauge their portfolio’s resilience under adverse conditions. By preparing for the unexpected, investors can take preemptive measures to mitigate potential losses and enhance their financial security.

The Role of Debt and Leverage

Ray Dalio has consistently emphasized the prudent use of leverage to avoid overexposure to debt. While leverage can amplify returns, it also increases financial risk, particularly during economic downturns. Dalio advocates for a balanced approach, using leverage judiciously to enhance returns without compromising financial stability.

Understanding debt cycles is another critical aspect of Dalio’s strategy. He evaluates how debt accumulation impacts economic stability, recognizing that excessive debt can lead to financial crises. By monitoring debt levels and their effects on the economy, Dalio advises on strategies to manage debt responsibly and avoid potential pitfalls.

The Importance of Adaptability

Flexibility in strategy is paramount for navigating changing economic conditions. Dalio stresses the need for adaptive strategies that can evolve in response to new information and shifting market dynamics. This approach ensures that investors remain agile and prepared to seize opportunities or mitigate risks as they arise.

Learning from past mistakes is a cornerstone of Dalio’s investment philosophy. By reflecting on previous errors and successes, both personally and organizationally, Dalio believes that individuals and companies can enhance their decision-making processes. This continuous learning cycle fosters resilience and paves the way for improved outcomes in future financial endeavors.

For more insights into Dalio’s approach and its relevance to current economic challenges, consider exploring his efforts to share knowledge that could help avoid a US debt crisis, as discussed in this Benzinga article.

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.