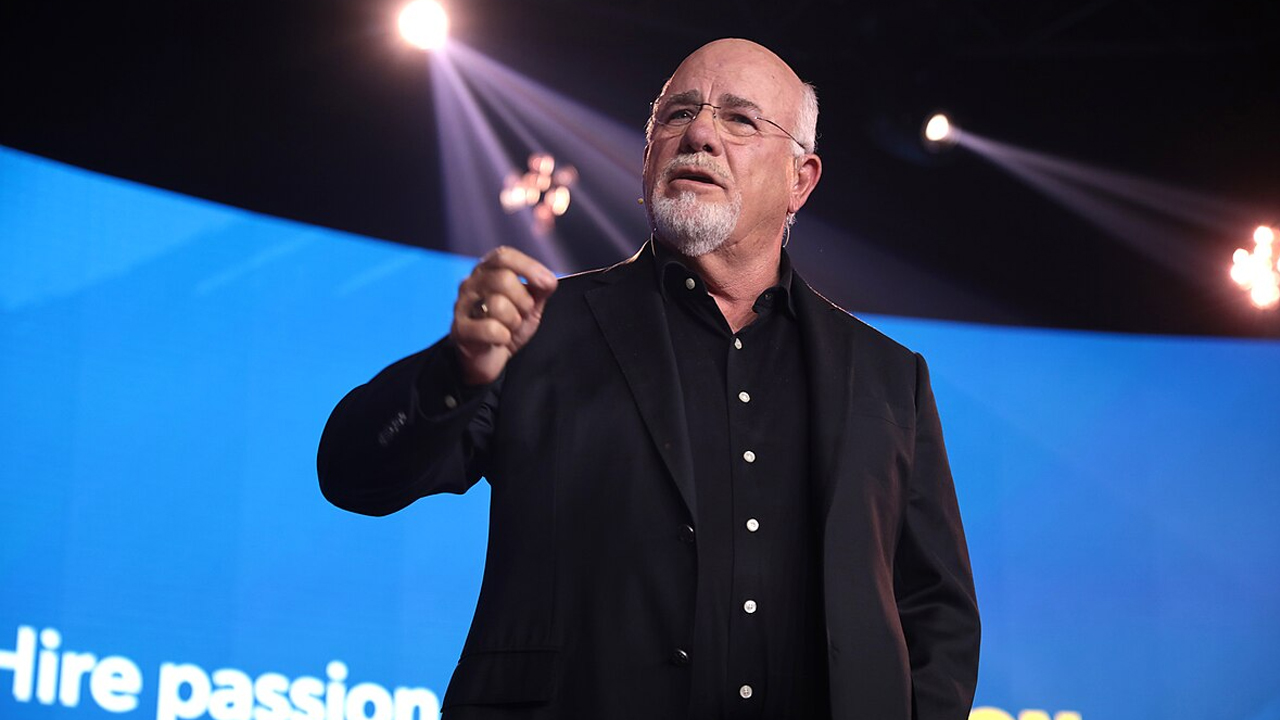

When it comes to retirement, Dave Ramsey doesn’t sugarcoat anything. He’s been known for years as the guy who tells it like it is—and his recent comments about 401(k)s, IRAs, and Social Security are no exception. Whether you’re in your 30s or pushing 60, understanding what Ramsey says about these accounts could shape the way you plan the rest of your financial future. His approach isn’t flashy, but it’s grounded in long-term thinking, personal responsibility, and avoiding common traps that leave people broke in their later years.

Start with Your 401(k) Contributions

Dave Ramsey doesn’t mince words—your 401(k) should be one of the first places you invest for retirement, especially if your employer offers a match. That match is free money. Not taking it is like turning down a raise. Just contributing enough to get the full match already gives you a major head start.

Once you’ve secured that match, Ramsey suggests looking beyond your 401(k) for more flexibility and tax advantages. That way, you’re not putting all your retirement plans in one basket. You’re spreading the risk and opening the door to more tax-efficient growth.

(Source: Ramsey Solutions)

Incorporate a Roth IRA into Your Retirement Plan

After maxing out your 401(k) match, Ramsey points to the Roth IRA as a smart next step. The money you put in is after-tax, but the growth and withdrawals are completely tax-free in retirement. That can be a big win later on—especially if tax rates go up or your income climbs.

It also gives you more control over how you invest and access your money. It’s about building a retirement setup that gives you options, not limitations.

(Source: Ramsey Solutions)

Understand the Limitations of Social Security

Ramsey’s take on Social Security is blunt—don’t count on it to carry you through retirement. The average monthly benefit is around $1,900, which barely clears the poverty line for a household of two. That’s not enough for most people to live comfortably, especially with rising costs.

The point isn’t to ignore Social Security—it’s to make sure your retirement doesn’t depend on it. That means building your own plan with intentional saving and investing.

(Source: INKL)

Prioritize Debt Elimination Before Investing

Ramsey’s rule is simple: get rid of non-mortgage debt before diving deep into retirement investing. If you’re carrying high-interest debt, that’s money bleeding out every month—and it usually outweighs any investment returns. So for a while, the focus should shift to wiping that debt out.

Once you’re in the clear, you’ll be in a much better position to build serious wealth. With debt gone and an emergency fund in place, every dollar you invest starts working for your future without dragging any liabilities behind it.

(Source: Reddit)

Be Mindful of Hidden Fees in Retirement Accounts

One of Ramsey’s lesser-talked-about warnings is about the sneaky fees hiding in your retirement accounts. These fees—like administrative charges or mutual fund expense ratios—can quietly chip away at your investments over the years.

The solution? Stay on top of your account statements, ask questions, and lean toward low-cost index funds when possible. Even shaving off half a percent in fees can mean tens of thousands more in your account down the line.

(Source: LinkedIn)

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.