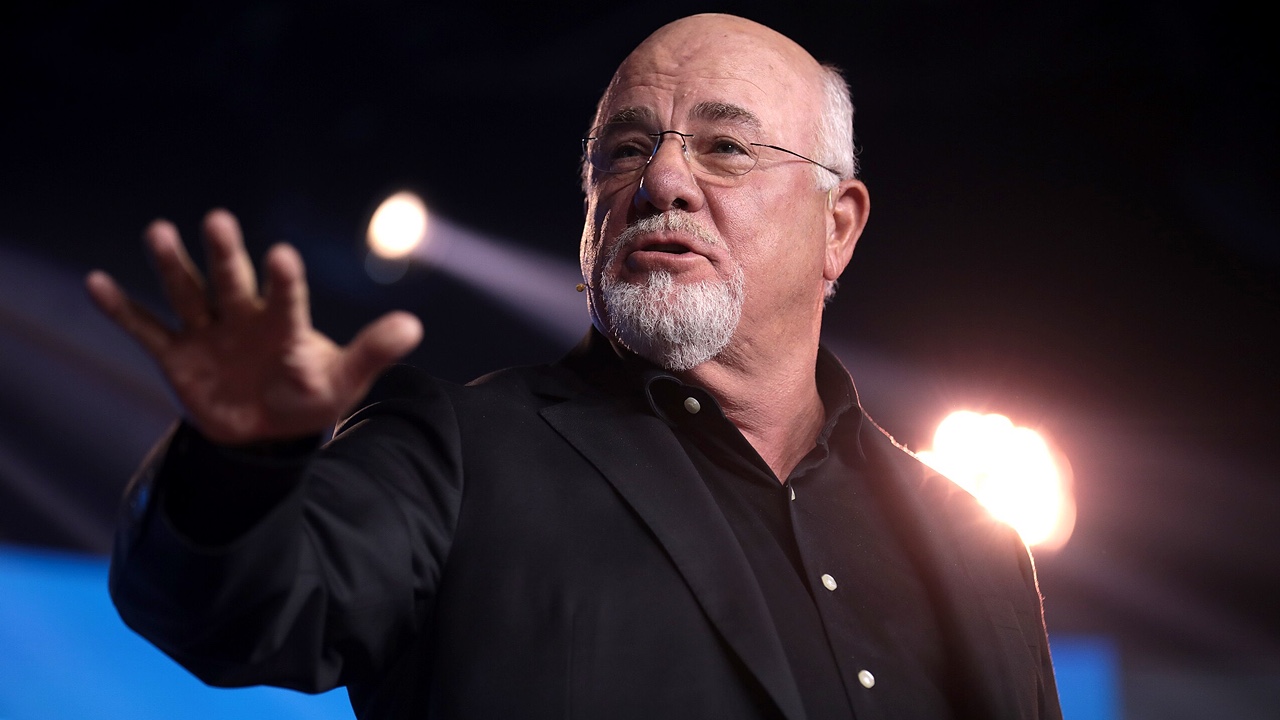

Dave Ramsey, the well-known financial advisor and radio host, often shares valuable insights into what separates the financially successful from those who struggle. One key distinction, according to Ramsey, lies in the questions they ask when making a financial decision. (Source: Ramsey Solutions)

Wealthy individuals approach a purchase by asking, “How much does it cost?” Meanwhile, those with financial challenges often ask, “How much is the down payment?”

This difference reflects more than just buying habits—it reveals contrasting mindsets about money and debt. While the wealthy focus on the total cost and its impact on their financial goals, others are drawn in by the allure of manageable upfront payments, often overlooking the true cost of debt over time.

The Burden of Debt in America

Debt has become a significant part of everyday life for many Americans, and the numbers paint a sobering picture:

- 1 in 3 Americans have maxed out their credit cards, according to Debt.com.

- The average American carries $104,215 in debt, including mortgages, student loans, credit cards, and auto loans. (Source: Federal Reserve Bank of New York)

- The national debt is growing by a staggering $1 trillion every fiscal quarter, adding to the financial pressure.

Credit card debt is a major contributor to this problem. Balances exceeded $1 trillion by late 2023, with interest rates reaching historic highs. Here’s what the Debt.com report uncovered about how Americans are managing their credit:

- 45% have used credit cards to cover basic necessities due to inflation.

- 35% of respondents have completely maxed out their cards.

- Among those with maxed-out cards, 85% blame rising prices as the primary cause.

- 22% carry balances between $10,000 and $20,000, while 5% owe more than $30,000.

This dependency on credit is not just a personal issue—it’s big business. Companies like Visa and MasterCard continue to thrive, with stock prices approaching record highs. For example:

- Visa’s stock recently reached $296, and analysts predict it could climb to $347 within a year.

- MasterCard is trading at $506, with forecasts of hitting $544 soon. (Source: Forbes)

Building Financial Stability in an Over-Marketed World

Ramsey’s core advice is simple: If you can’t afford it, don’t buy it. While that may sound straightforward, modern life makes it harder than ever. Social media, targeted ads, and marketing campaigns constantly tempt us with things we don’t truly need. Pair that with inflation and economic uncertainty, and sticking to this principle becomes a real challenge.

Still, there are practical steps you can take to regain control of your finances:

1. Start with a Budget and Savings Plan

Creating a weekly budget is essential for identifying where your money is going. Break your spending into “needs” and “wants,” and track every dollar. Even saving small amounts each week adds up over time.

- Pro tip: Automate your savings so it happens consistently without effort.

2. Rethink Credit Card Usage

Credit cards often come with high interest rates that can double or triple the cost of everyday purchases if balances aren’t paid off quickly. Switching to cash or a debit card can keep your spending in check and make you more aware of your financial habits.

- For example, a $10 fast-food meal bought with a credit card can cost over $20 in the long run if it takes months to pay down the balance.

3. Explore Debt Consolidation

If you’re struggling with multiple high-interest debts, debt consolidation might help. Refinancing to a lower interest rate can make monthly payments more manageable and accelerate your progress toward becoming debt-free. With recent rate cuts from the Federal Reserve, now might be a good time to explore this option.

The Bottom Line

The mindset shift from “How much down payment?” to “How much does it cost?” can make a significant difference in financial outcomes. By adopting better habits—like budgeting, avoiding unnecessary debt, and seeking smart solutions like consolidation—you can start moving toward greater financial security.

The path to financial stability may not be easy, but small, consistent changes can lead to a brighter future, free from the heavy burden of debt.

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.