Garage sales can be a goldmine for overlooked treasures—and watches are one of the most underappreciated categories. That scratched-up timepiece in a $5 shoebox could be worth thousands. Some of the world’s most collectible watches have been found buried in junk drawers, mispriced by sellers who had no idea what they were holding.

If you know what to look for, spotting a valuable watch becomes a skill worth mastering. Here’s how to tell if that yard-sale special is secretly worth a small fortune.

Start with the Brand—Always

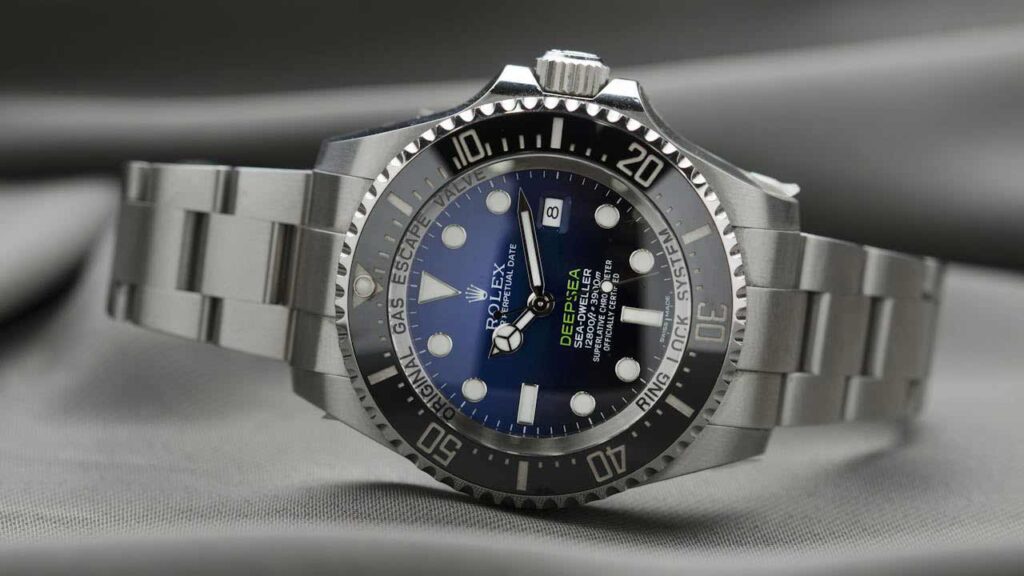

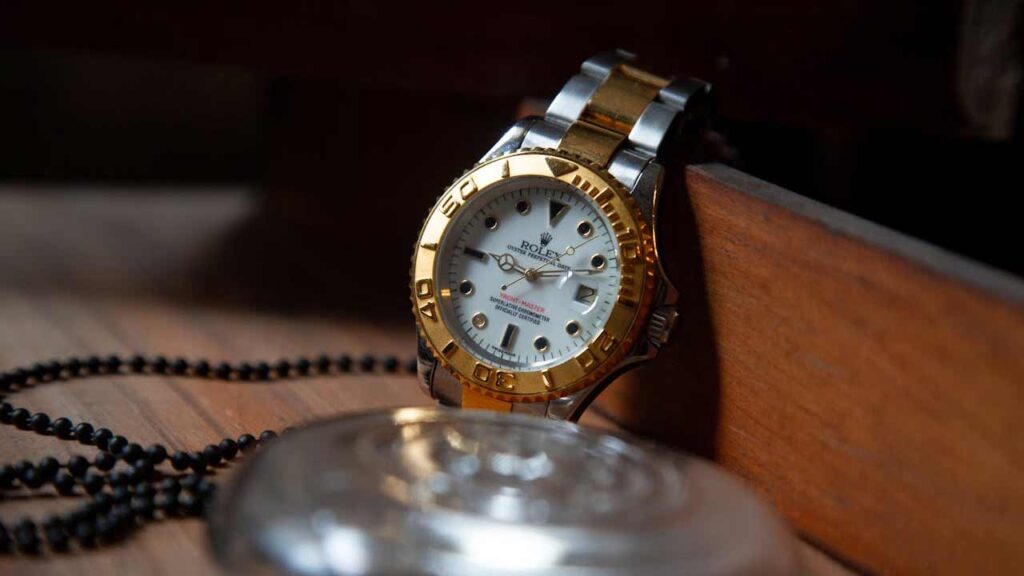

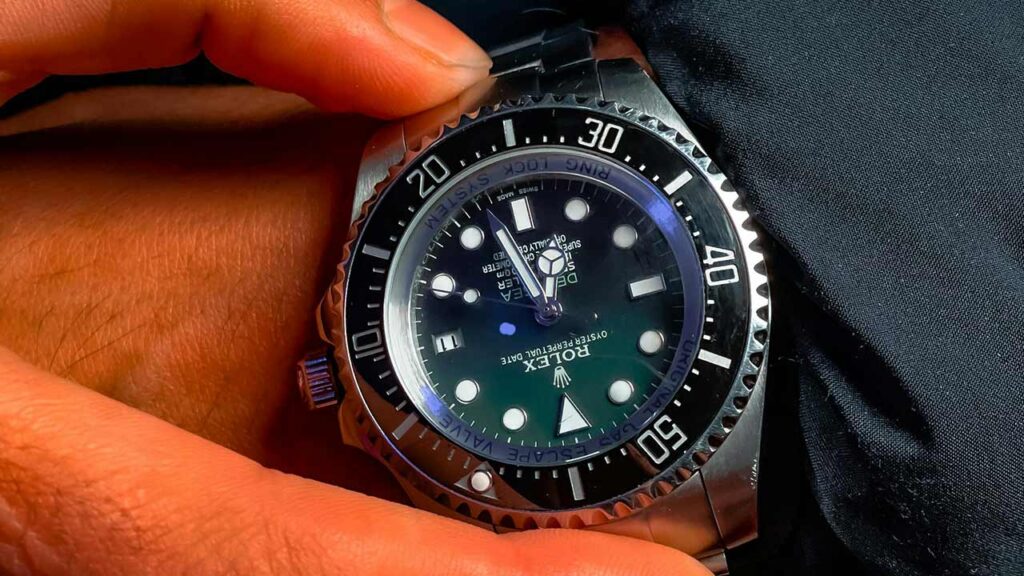

The first thing to check is the name on the dial. Well-known brands like Rolex, Omega, Patek Philippe, Heuer (pre-TAG), Seiko, and Breitling can all command serious value, especially vintage models. Don’t expect to see a clean logo—older watches might have faded dials or missing letters.

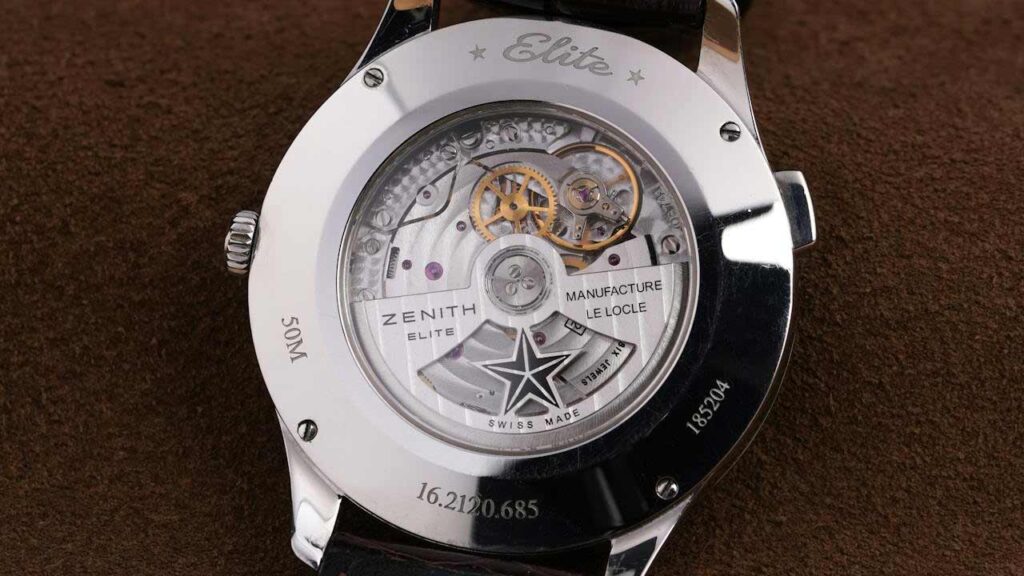

Even lesser-known Swiss brands like Longines, Zenith, and Universal Genève are gaining traction with collectors. And don’t write off Seiko—certain vintage divers and chronographs sell for thousands.

Flip It Over and Look for the Case Back Info

The back of the case often holds clues: serial numbers, model references, or hallmarks. Swiss watches usually have a country stamp (“Swiss Made”), and some include precious metal markings (like “14K” or “18K”) that indicate gold cases. A few even have engraved dedications, which can help date the piece.

If the case has a screw-down back or is unusually heavy, it could be housing something special inside—like an automatic movement or rare caliber.

Check the Movement (If You Can Open It)

Inside the case is where the real value often lives. Manual wind or automatic mechanical movements are generally more desirable than quartz (battery-powered) ones—especially if the movement is marked with the same brand as the case.

If you’re able to pop it open safely (or the seller already has), look for clean, engraved movements with jeweled bearings. Movements made by ETA, Valjoux, Lemania, or even in-house calibers from Rolex or Omega are a major plus.

Weight and Build Quality Are Big Tells

Cheap watches feel cheap. A watch that has some heft, a solid bracelet, or a smooth-moving crown usually points to higher quality. Plastic crystals, loose bezels, and hollow-feeling bracelets are red flags for low-end models or knockoffs.

That said, don’t expect every valuable watch to shine. A well-made watch with scratches or a cracked crystal can still be worth a lot—especially if it’s rare or all-original.

Look for Chronographs, Divers, and Military Styles

Watches with extra features—chronographs (multiple dials), rotating bezels, or military-style markings—are in high demand. These functional watches were often made in lower quantities and have devoted followings.

Keep an eye out for anything labeled “pilot,” “diver,” “GMT,” or with tritium (marked “T<25” on the dial). These niche models can fetch far more than standard dress watches, even from the same brand.

Don’t Dismiss Damaged or Non-Working Watches

Collectors and watchmakers regularly buy non-working vintage watches for parts or restoration. A dead Rolex with a cracked crystal might still be worth thousands. Even obscure brands can bring in hundreds if the model is rare enough.

Sometimes the biggest profits come from pieces that look rough but have the right bones underneath. Especially if the watch is untouched and comes with the original band or box.

Bottom Line: Know the Signs—Not Just the Name

You don’t need to be a horologist to spot value. Learn the brands, check the weight, scan the case back, and look up serial numbers if possible. A five-minute Google search can turn a $10 garage sale find into a $5,000 flip.

Because when it comes to watches, the value’s not just in the time—it’s in the timing. And you never know what someone might be selling for pocket change this weekend.

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.