Florida has long been a hotspot for homebuyers, retirees, and investors looking for sunshine and tax advantages. But not all cities in the Sunshine State are built for long-term value. Between rising insurance premiums, climate risks, and volatile price swings, some areas are giving real estate agents pause. If you’re thinking about buying in Florida, here are five cities many pros suggest you think twice about.

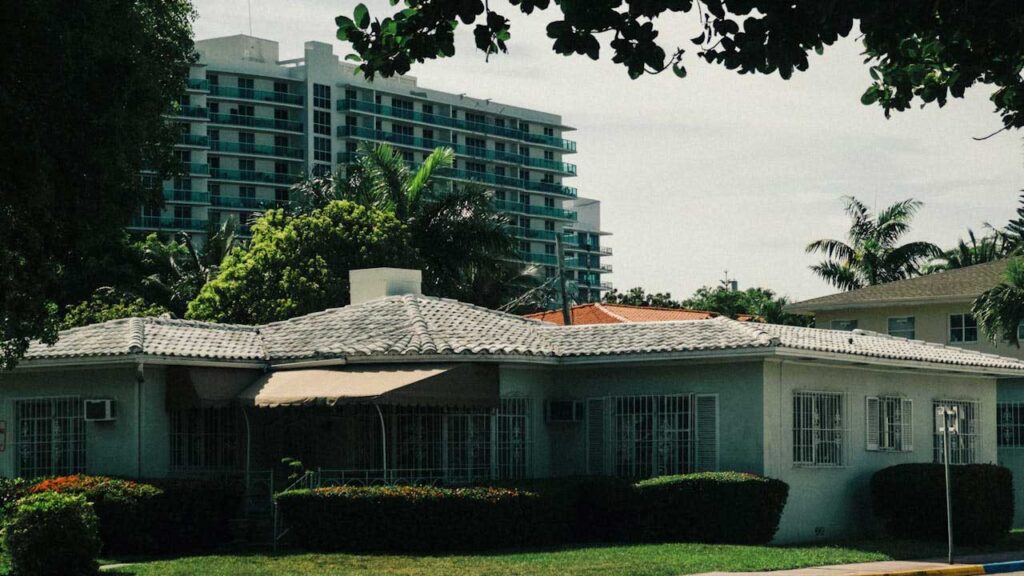

1. Miami

Miami may have glitz and nightlife, but the real estate math doesn’t always add up. Prices have surged to record highs, with the median sale price now at $675,000—well above what most locals can afford. According to Redfin, home prices are still rising, even as sales volume declines.

Real estate agents warn that the market feels overheated, and investors banking on short-term rentals are facing tighter local restrictions. Add in flood zone concerns and rising insurance premiums, and Miami becomes a high-risk buy for long-term homeowners.

2. Cape Coral

Cape Coral saw explosive growth during the pandemic, but that wave may be leveling off. Prices are still high, yet inventory is climbing. Agents have flagged the area for its vulnerability to hurricanes and reliance on speculative building.

After Hurricane Ian, some parts of the city faced insurance rate hikes of over 50%, according to Insurance Journal. If you’re buying here, know that what looks like a deal today could come with long-term repair and insurance headaches.

3. Palm Bay

Palm Bay may look affordable on paper, with average home values around $312,000—but agents say many homes in the area are in flood-prone zones with older infrastructure. What you save on the listing price, you could end up spending on repairs and maintenance.

It’s also a slower market, with fewer amenities and longer time on market for resales. According to Zillow, home values have decreased by 3.7% over the past year. For now, it’s a market best approached with caution.

4. Port St. Lucie

Port St. Lucie has been booming—but that’s not always a good thing. Agents are raising red flags about rapid development outpacing infrastructure. Roads, schools, and utilities are playing catch-up with the city’s growth, which could impact resale value and quality of life.

The median home price is nearing $400,000, but CBS News reports that the area is among the fastest-growing in the nation, which could lead to a price correction if demand doesn’t keep up—especially as interest rates hold steady.

5. North Port

Located in Sarasota County, North Port has been on many investor radars, but some agents are urging a second look. The area was hit hard by recent storms, and rebuilding costs are rising. Many new developments are built quickly and cheaply, with long-term durability in question.

According to New York Post, North Port’s real estate market is cooling, with listings lingering longer and price cuts becoming more common. It’s still livable—but may not be a smart long-term hold.

Thinking about buying in Florida? Before you commit, compare flood risk data at Flood Factor, browse current market trends on Redfin, and check property insurance forecasts via Insurance.com.

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.