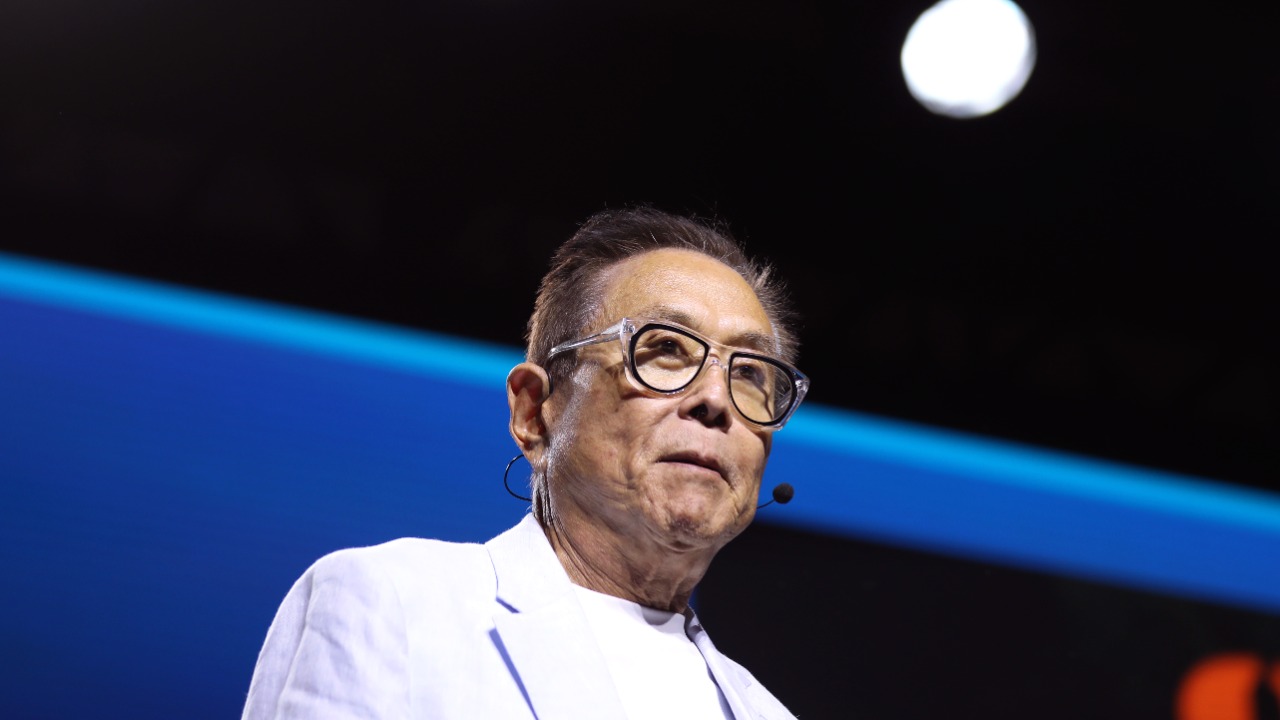

Robert Kiyosaki, renowned author of “Rich Dad Poor Dad,” has long been a vocal advocate for financial education and investment in assets that generate wealth. As we look toward the next decade, Kiyosaki is focused on a few key asset classes that he believes will offer substantial returns. Here, we explore Kiyosaki’s favorite assets and why he considers them pivotal for the future.

Precious Metals: A Safe Haven in Uncertain Times

Kiyosaki emphasizes the importance of gold and silver as a hedge against inflation and economic instability. These metals have historically been considered a reliable store of value, especially during periods of financial uncertainty. Their intrinsic value is not tied to any single currency, making them an attractive option for preserving wealth.

The historical performance of precious metals reveals their resilience during financial downturns. For example, gold prices often rise when global markets face turbulence, offering a level of security that paper currencies cannot. Additionally, precious metals provide diversification benefits, allowing investors to balance their portfolios and reduce exposure to risk inherent in other asset classes.

Cryptocurrencies: The Digital Frontier

Bitcoin has been dubbed the “people’s money” by Kiyosaki, who sees it as a promising store of value in the digital age. Unlike traditional currencies, Bitcoin is decentralized and operates on a peer-to-peer network, which Kiyosaki believes enhances its potential as a hedge against centralized financial systems.

Beyond Bitcoin, emerging altcoins present intriguing opportunities. Kiyosaki is particularly interested in the potential of blockchain technology to revolutionize industries, from finance to supply chain management. The innovation and efficiency it offers make blockchain an attractive area for investment, as it continues to gain traction across various sectors.

Real Estate: Tangible and Reliable Wealth

Real estate remains a cornerstone of Kiyosaki’s investment strategy, with a focus on both residential and commercial opportunities. The potential for steady cash flow and appreciation makes real estate a dual-benefit asset. Kiyosaki often highlights the importance of identifying markets poised for growth, which can yield significant returns over time.

Understanding macroeconomic trends is crucial for making informed real estate investment decisions. Factors such as population growth, urbanization, and economic development can significantly impact market dynamics. By staying abreast of these trends, investors can better position themselves to capitalize on opportunities in the real estate sector.

Commodities: Investing in Essentials

Commodities, particularly energy resources like oil, play a significant role in Kiyosaki’s investment strategy. The global demand for energy is unlikely to wane, and fluctuations in supply can lead to substantial price movements. Investing in energy commodities provides a way to tap into this essential sector.

Agricultural products also hold value in Kiyosaki’s eyes, as they are fundamental to human survival. The growing global population and changing dietary habits drive demand for food commodities. By investing in these essentials, investors can potentially benefit from upward price trends driven by shifting global demand.

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.