It’s one of the oldest debates in personal finance: should you throw extra cash at your mortgage—or invest it instead? In 2025, with interest rates, inflation, and market returns all shifting, the answer depends less on math and more on strategy.

There’s no one-size-fits-all rule. But there are key factors that separate an emotional decision from a smart financial move. Here’s how to think through it this year.

Run the Real Math—Not Just the Emotional Math

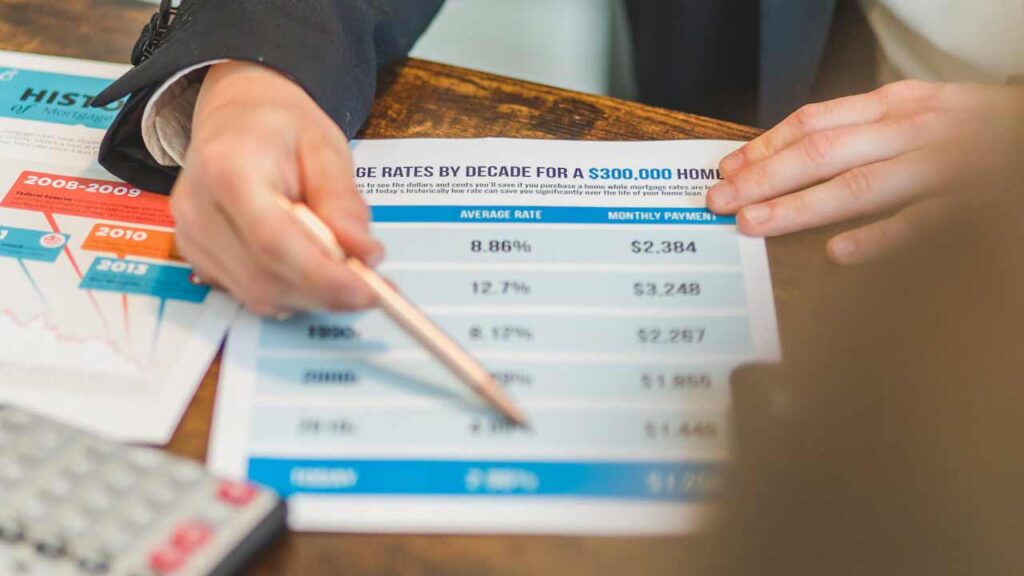

Paying off a mortgage early can feel amazing. No debt, lower monthly expenses, and a sense of freedom. But financially, the math has to make sense. If your mortgage rate is locked at 3.5% and you could reasonably earn 6–8% investing, the gap matters.

That 2–4% spread, compounded over 10–20 years, can mean hundreds of thousands in future value. But it only works if you actually invest the difference—not just save it or spend it. That’s where most people fall short.

Cash Flow Flexibility Might Be More Valuable

In a high-cost, uncertain economy, having lower fixed expenses can buy you options. Retiring early, changing careers, starting a business—all become easier without a mortgage hanging over you.

Some high earners in 2025 are choosing to pay off their homes early—not because it’s the highest ROI, but because it gives them mental clarity and monthly breathing room. That’s not the wrong move. It’s just a different kind of return.

Consider Opportunity Cost—and Liquidity

When you pay off your mortgage, that money is locked in your house. You can’t easily pull it out if a better opportunity shows up next month. Investing, on the other hand, keeps your capital liquid and available for moves with bigger upside—real estate deals, market dips, or business plays.

Liquidity matters in 2025. The world’s moving fast, and the people with accessible capital can strike when others are stuck.

Age and Timeline Shift the Equation

If you’re in your 30s or 40s, maximizing investment growth might serve you better long-term. If you’re in your 50s or 60s, the stability of owning your home outright can be more appealing—especially if you’re approaching retirement or cutting back hours.

Millionaires still carry mortgages when it makes financial sense. But they also know when it’s time to prioritize peace of mind over optimization. The key is knowing which phase you’re in.

In 2025, Balance Might Be the Smartest Play

You don’t have to go all in on one path. Some homeowners are splitting the difference—paying a little extra on their mortgage while also investing. Others are using HELOCs or recasting options to stay flexible while still reducing debt over time.

The point isn’t perfection. It’s progress in both directions—building equity while still growing your portfolio. That balance keeps you nimble no matter what the market does next.

It’s Not Just About Interest Rates—It’s About Intent

Paying off your mortgage early or investing more isn’t just a numbers game. It’s about how you want your money to work for you. In 2025, the best move is the one that gives you both control and growth—without locking you into someone else’s idea of financial success.

Run the numbers. Know your goals. And make the decision that builds the life you actually want—not just the one that looks good on paper.

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.