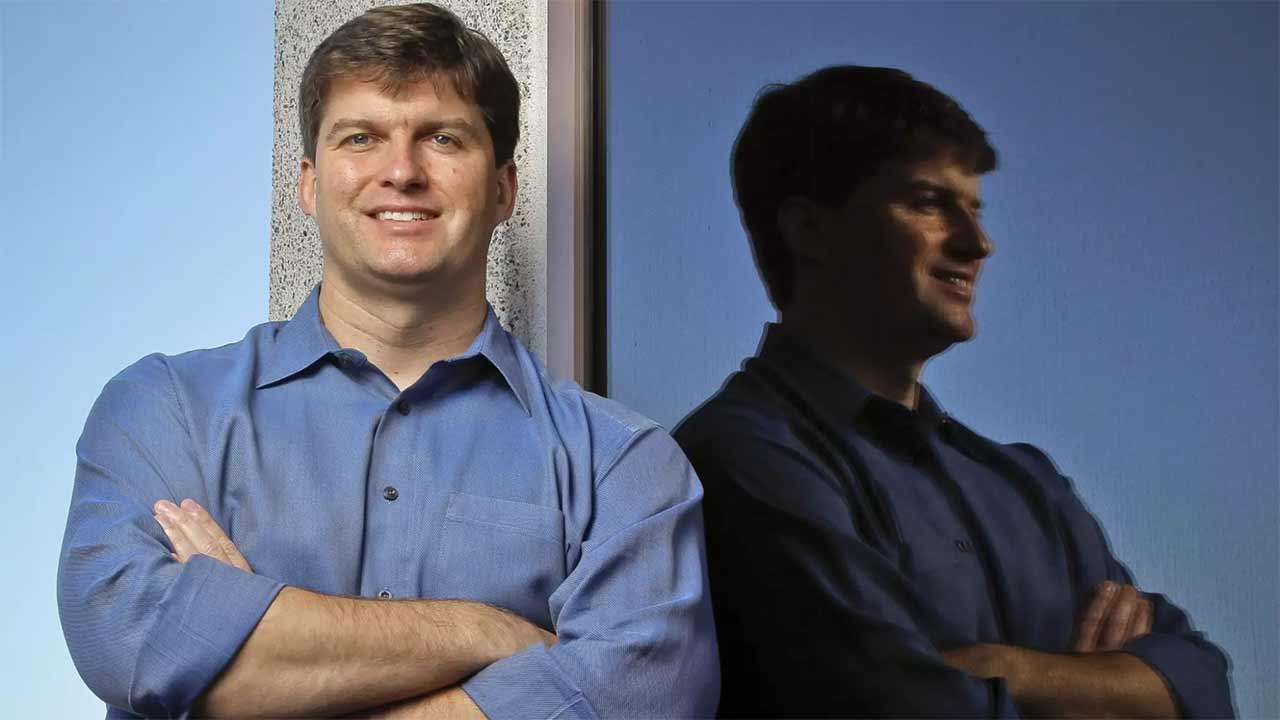

Michael Burry is known for making bold, often contrarian bets. He called the housing crash before anyone else believed it was real. He shorted the stock market while others were piling in. So when he makes a move, people pay attention—especially when it’s not the kind of stock you’d expect him to touch.

This Time, It’s Alibaba

In a recent filing, Burry’s Scion Asset Management disclosed a new position in Alibaba—China’s biggest eCommerce giant. It’s not the typical pick you’d expect from a guy who once bet everything against the U.S. housing market. But that’s what makes it interesting.

After years of regulatory pressure and market uncertainty, Chinese tech stocks have been hammered. Most U.S. investors have backed away. Burry? He’s leaning in. And he’s doing it while prices are still far below their previous highs.

He’s Betting on Deep Value—Again

Burry’s investment style is simple: find assets the market has mispriced, buy in when fear is high, and wait for the value to surface. Alibaba fits that mold. It’s still profitable, still growing in key areas, and trading at a discount compared to its U.S. peers.

Most investors have written it off due to geopolitical risk. But Burry sees what others are ignoring—real cash flow, strong fundamentals, and a company that’s been beaten down more than it deserves.

He’s Comfortable Holding What Others Won’t Touch

This isn’t a trend-following move. Burry doesn’t care about momentum or market sentiment. He’s always operated in uncomfortable zones—whether it was betting against subprime mortgages or shorting meme stocks while the internet screamed the opposite.

With Alibaba, he’s once again stepping into a position that most investors are too nervous to take. And history says that’s when he’s usually right.

It’s Not Just About China

Alibaba’s growth isn’t limited to China. The company has expanded into Southeast Asia, cloud computing, logistics, and AI. It’s quietly building an ecosystem that reaches far beyond eCommerce. While most headlines focus on China’s political climate, Burry may be zooming out to the bigger picture.

For him, it’s not about where the company is—it’s about what it’s worth. And by his math, it’s currently trading far below its true value.

This Is Classic Burry Behavior

When the market runs from fear, Burry walks straight into it. He’s built his entire career on zigging when others zag. And while Alibaba isn’t the kind of stock most value investors are talking about right now, that’s exactly why he bought it.

It’s a reminder that some of the best opportunities show up when nobody else wants to touch them.

The Bottom Line

Michael Burry doesn’t make safe bets. He makes calculated ones. His recent move into Alibaba isn’t about hype—it’s about finding value where others see risk. If history repeats itself, the stock no one expected him to buy could end up being one of his smartest plays yet.

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.