The Rule of 72 is one of the simplest tools in personal finance—and one of the most misunderstood. It’s supposed to give you a quick way to figure out how long it takes your money to double based on a fixed interest rate. But most people either apply it too casually or miss what it’s actually telling them about compounding and time.

Here’s How the Rule Works

The Rule of 72 is simple: take the number 72 and divide it by your annual return rate. The result is how many years it takes your money to double. For example, if your investments grow at 9% annually, 72 ÷ 9 = 8. That means your money should double in about 8 years.

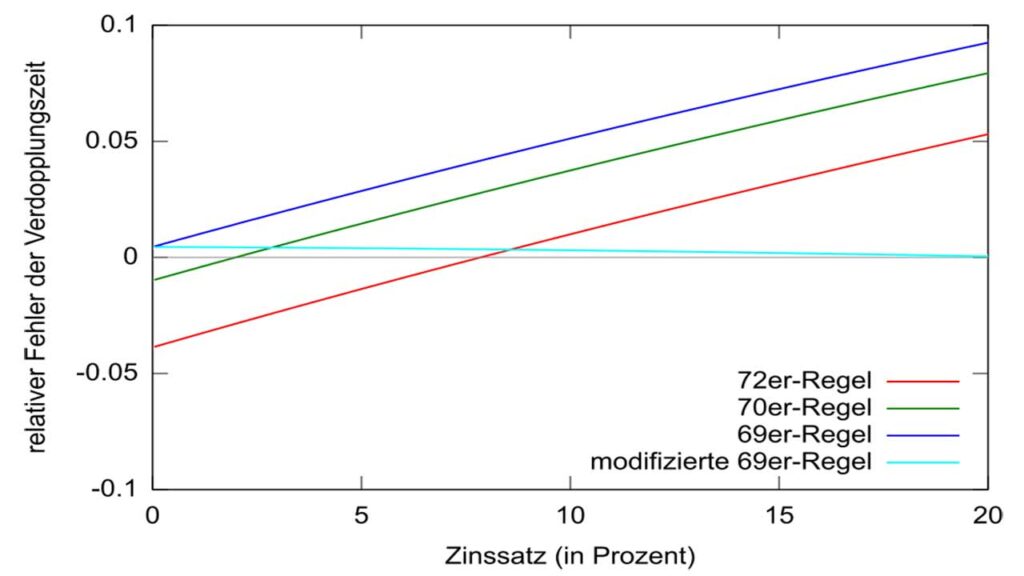

It’s not perfect math—but it’s close enough to be useful for quick estimates. And for anything between 6–10% returns, it’s surprisingly accurate.

What Most People Miss

The Rule of 72 shows how powerful compounding can be—but too many people stop at the first double. If your money doubles every 8 years, it doesn’t just grow slowly. It starts stacking fast. Over 24 years at 9%, $5,000 doesn’t just become $10,000—it becomes $40,000.

That’s what most people underestimate. The real value of compounding doesn’t show up in the early years. It explodes later. Missing even a few years on the front end can mean missing out on hundreds of thousands down the road.

It’s a Wake-Up Call on Delaying

If you wait 10 years to start investing, it doesn’t just delay growth—it costs you full doubling cycles. Using the same 9% example, someone who starts with $10,000 at age 25 could end up with $160,000 by retirement. Someone who waits until 35? That same $10,000 might only hit $80,000.

Time in the market isn’t just a saying—it’s the whole game. And the Rule of 72 makes that brutally clear.

It Works in Reverse Too

Want to know how much return you’d need to double your money in a certain time frame? Flip it. Want to double your money in 6 years? 72 ÷ 6 = 12. You’d need a 12% annual return. That’s aggressive, but it puts your goals in perspective.

And if you’re looking at high-interest debt, it’ll show you how quickly things can go the other way. At 24% interest, your balance could double in just 3 years if left unpaid. The Rule cuts both ways.

The Bottom Line

The Rule of 72 isn’t just a mental shortcut—it’s a lens for understanding the true cost of time. It shows why starting early matters, why compounding is powerful, and why delay can be expensive. It’s not about getting exact numbers—it’s about seeing the bigger picture. And the picture is this: time is either your biggest asset, or your biggest regret.

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.