Airbnb arbitrage—renting a property long-term and re-renting it short-term—has become a popular strategy for generating income without owning property. In 2025, certain states stand out for their favorable regulations, strong tourism, and profitable markets. Here’s a look at the top seven states where Airbnb arbitrage is thriving.

1. Tennessee

Tennessee, particularly cities like Nashville and Gatlinburg, offers a mix of urban and nature-focused destinations. Nashville’s vibrant music scene and Gatlinburg’s proximity to the Great Smoky Mountains attract year-round visitors. The state’s relatively lenient regulations make it a hotspot for short-term rentals.

Investors find opportunities in areas with high tourist traffic and events. With proper management, properties can yield significant returns, especially during peak seasons and festivals.

2. South Carolina

South Carolina’s coastal cities, such as Charleston and Myrtle Beach, are known for their historic charm and beaches. Charleston’s tourism draws consistent demand, and while regulations exist, they are manageable for informed investors.

By focusing on desirable neighborhoods and understanding local ordinances, arbitrage operators can capitalize on the steady influx of visitors seeking short-term accommodations.

3. Arizona

Arizona’s cities like Phoenix and Flagstaff offer diverse attractions, from desert landscapes to ski resorts. The state’s laws are favorable to property rights, limiting municipal restrictions on short-term rentals.

This legal environment, combined with year-round tourism, provides a conducive setting for Airbnb arbitrage, especially in areas near major events and natural attractions.

4. Florida

Florida remains a top destination for tourists, with cities like Orlando and Miami leading the way. Orlando’s theme parks and Miami’s beaches ensure a constant flow of visitors.

While some cities have stricter regulations, many areas in Florida are welcoming to short-term rentals. Success in this state often depends on selecting the right location and staying compliant with local laws.

5. Texas

Texas offers a variety of markets for Airbnb arbitrage, from the cultural hubs of Austin and San Antonio to the business centers of Dallas and Houston. The state’s large population and diverse attractions contribute to consistent demand.

Regulations vary by city, but many areas are accommodating to short-term rentals. Investors can find profitable opportunities by researching local ordinances and targeting high-demand neighborhoods.

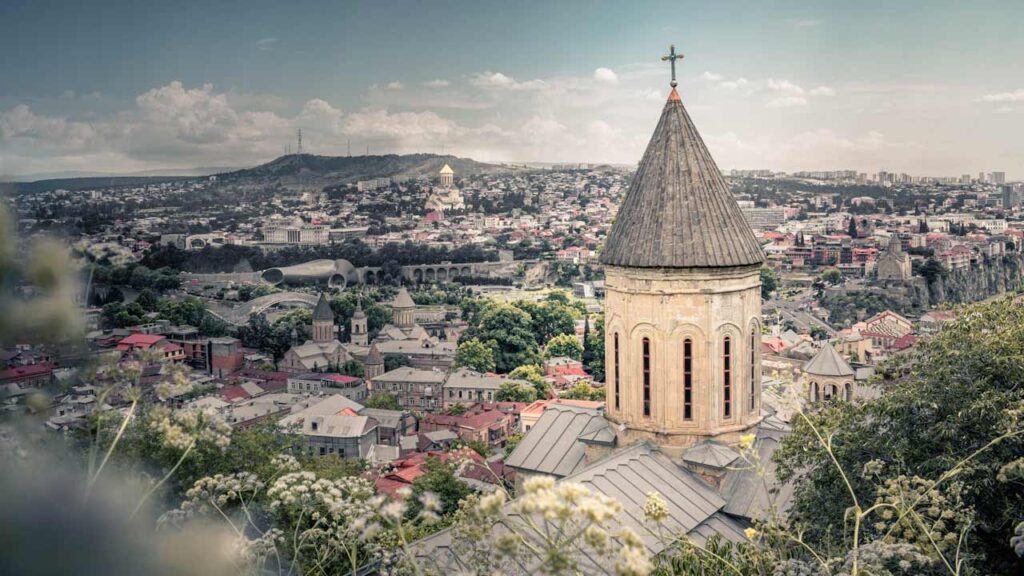

6. Georgia

Georgia’s cities like Atlanta and Savannah are rich in history and culture, attracting tourists and business travelers alike. Savannah’s historic districts and Atlanta’s events and conventions provide steady demand for accommodations.

Understanding local regulations and focusing on areas with high foot traffic can make Airbnb arbitrage a lucrative venture in Georgia.

7. North Carolina

North Carolina offers a mix of mountain retreats and coastal getaways. Cities like Asheville and Wilmington attract visitors year-round. The state’s diverse attractions and relatively flexible regulations make it appealing for short-term rental strategies.

By identifying popular tourist destinations and ensuring compliance with local laws, investors can tap into North Carolina’s growing short-term rental market.

The Bottom Line

Airbnb arbitrage in 2025 is thriving in states that combine tourist appeal with favorable regulations. Tennessee, South Carolina, Arizona, Florida, Texas, Georgia, and North Carolina each offer unique opportunities for savvy investors. Success in these markets hinges on thorough research, understanding local laws, and strategic property selection.

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.