Budgeting apps promise clarity, control, and financial peace of mind. But for most people, they just create one more thing to check—and eventually ignore. You download the app, sync your accounts, feel organized for about a week… then life happens, and the notifications start piling up.

The truth is, most budgeting apps fail because they’re built around tracking—not behavior. And if you want real results, you need something simpler, smarter, and aligned with how you actually live.

They Overcomplicate What Should Be Simple

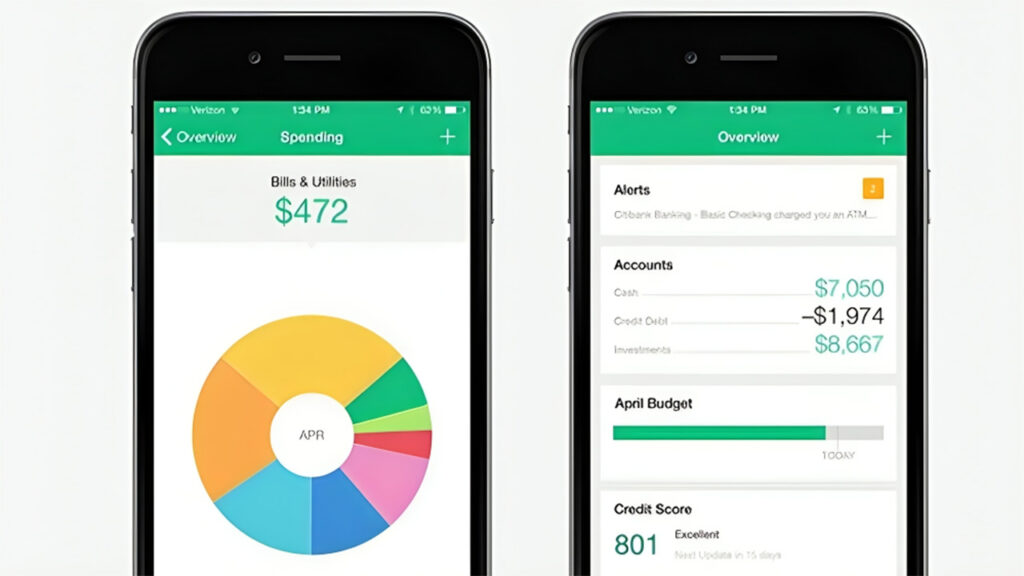

Some apps try to micromanage every purchase—categorizing your $4 coffee and splitting hairline expenses into 12 buckets. It feels productive at first, but it’s exhausting. After a few weeks, most people tune out and stop logging in altogether.

Budgeting shouldn’t feel like managing a spreadsheet for a Fortune 500 company. It should give you a quick snapshot of what’s available, what’s allocated, and what’s off-limits. The more complex the system, the faster it breaks down.

They Track the Past Instead of Directing the Future

Looking back at what you spent is helpful—once. But it doesn’t stop you from doing it again. Most apps act like mirrors, not maps. They reflect behavior, but they don’t guide it. And if you’re trying to change your habits, that’s not enough.

What you need is a plan that shows where your money’s going before you spend it—not after it’s already gone. That’s how you get ahead instead of playing catch-up every month.

They Rely Too Heavily on Syncing (and It Breaks Often)

One of the most common complaints about traditional budgeting apps is syncing issues. Accounts disconnect. Transactions double post. Categories get messed up. And once the numbers stop making sense, you stop trusting the system.

High-earners especially don’t have time to babysit their bank feed. The tool has to work without constant maintenance. Otherwise, it just becomes a digital version of the mess you were trying to clean up.

What to Use Instead: The 4-Account System

If you want to stay on top of your money without checking five apps a day, try the system that actual wealth builders use: four separate accounts, each with a clear purpose.

- Income Account: Where all your money lands.

- Bills + Living Account: Covers fixed costs and everyday expenses.

- Growth Account: For investments and wealth-building moves.

- Reserve Account: For savings, emergencies, and upcoming expenses.

Set fixed transfers every payday. Automate what you can. And only spend from your daily account. No apps. No tracking every transaction. Just clean separation and control.

If You Still Want an App—Use One That Focuses on Behavior

Apps like You Need A Budget (YNAB) or Tiller do better because they focus on planning money before you spend it. They give every dollar a job and make you stay intentional—not reactive. But they only work if you use them like a habit, not a scoreboard.

Pick a tool that helps you decide, not just observe. The goal is to build a system that lives outside the app—not inside it.

Tools Don’t Build Wealth—Habits Do

Most budgeting apps fail because they’re built to track data, not change behavior. And unless your behavior changes, your bank balance won’t either. The best system is the one you actually use—and the one that gives your money direction before it leaves your account.

If your budget isn’t working, the answer probably isn’t another app. It’s a better structure. And it starts with keeping things simple.

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.