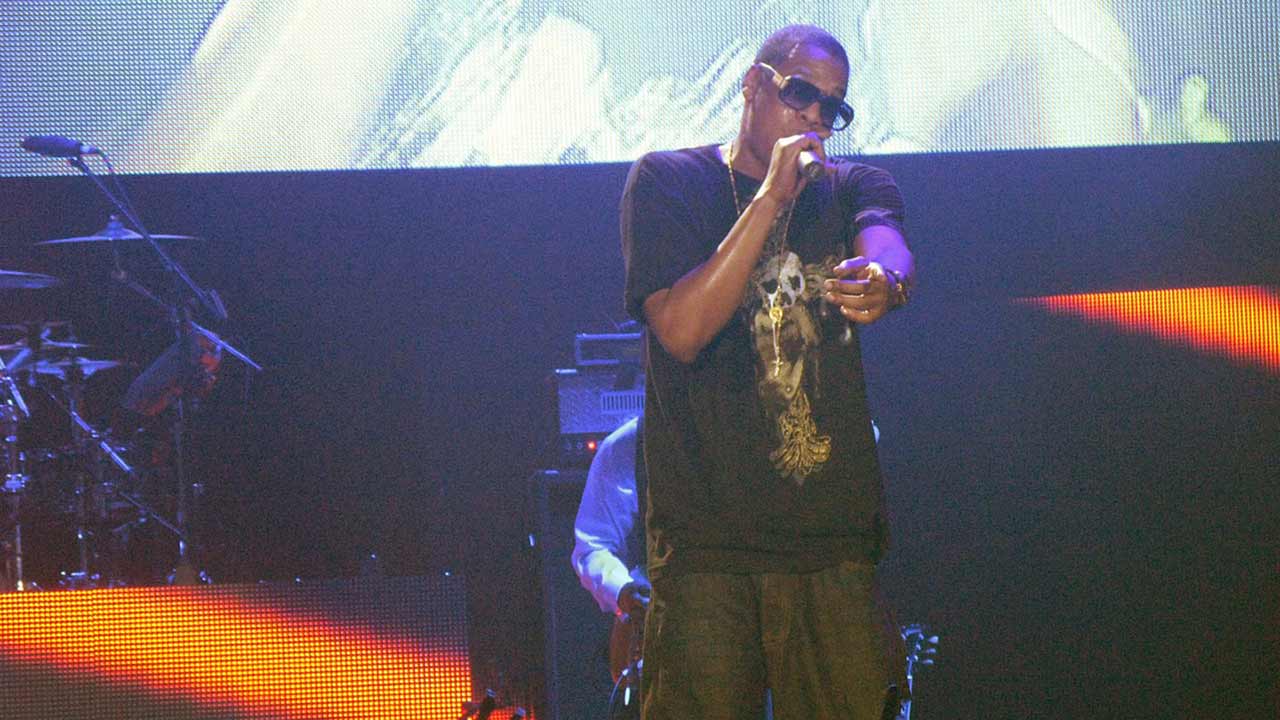

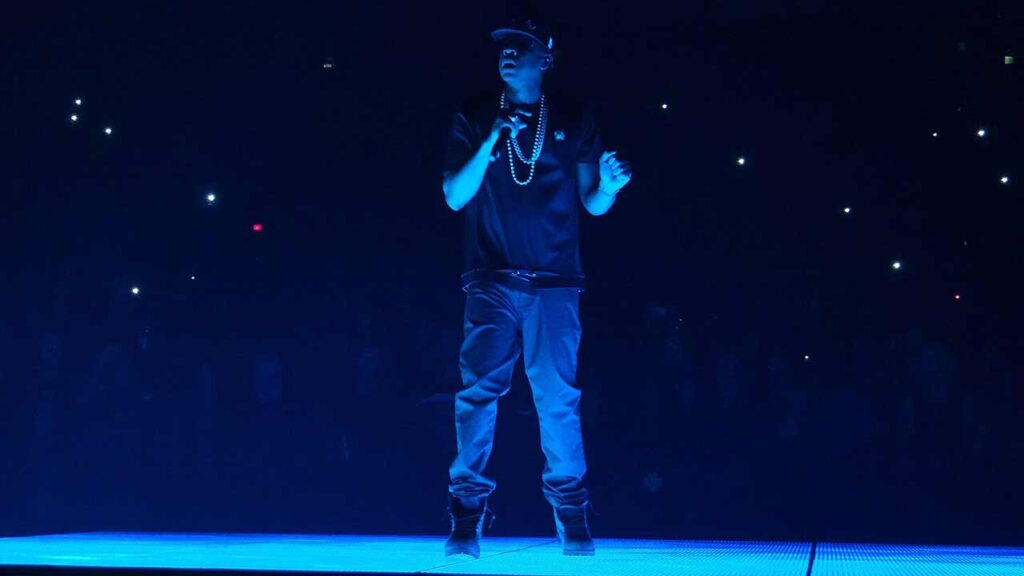

When Jay-Z dropped his debut album Reasonable Doubt in 1996, he wasn’t just launching a music career—he was laying the foundation for an empire. What started as an independent release from an unknown Brooklyn rapper has turned into one of the most diversified billionaire portfolios in entertainment history. And it didn’t happen by accident.

He Treated Music Like a Launchpad

Jay-Z never looked at music as the end goal. From the start, he viewed it as a way to build leverage. Reasonable Doubt gave him credibility, an audience, and ownership through Roc-A-Fella Records. That control meant he didn’t just earn off the music—he owned the asset.

Instead of chasing short-term fame, he used the buzz to negotiate bigger deals, build a brand, and step into boardrooms that most artists never reach.

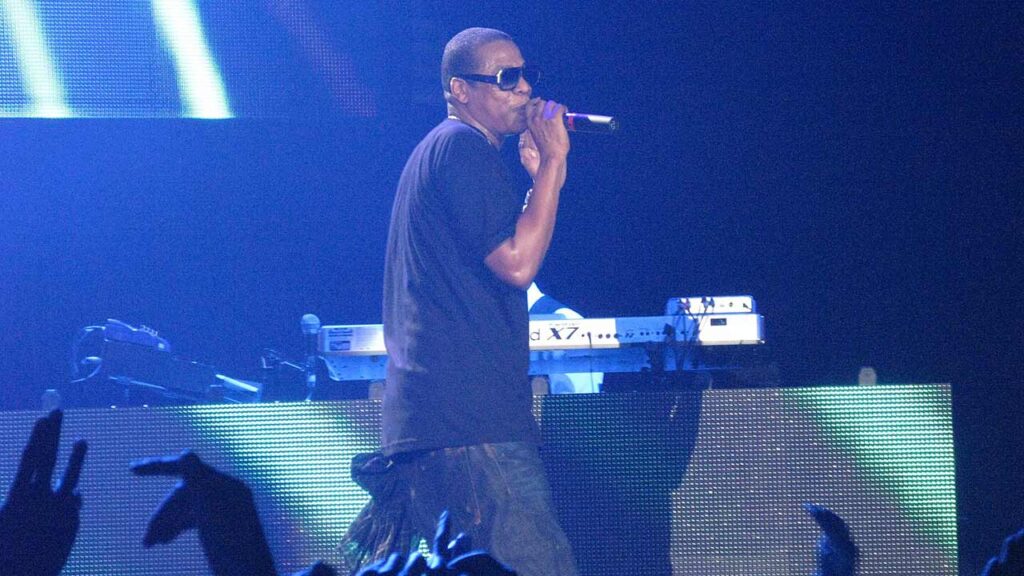

He Diversified Early—and Aggressively

By the early 2000s, Jay-Z had already expanded into clothing with Rocawear, liquor with Armand de Brignac, and sports with his stake in the Brooklyn Nets. These weren’t side hustles—they were core plays. And he didn’t just lend his name. He took equity and helped scale the businesses.

When he sold Rocawear for $204 million in 2007, it was clear: Jay-Z wasn’t just an artist—he was a builder. And the blueprint was already working.

Ownership Was Always the Priority

Jay-Z has always emphasized one thing: own what you create. Whether it’s music, clothing, or media, he’s been relentless about controlling his stake. He’s walked away from deals that didn’t offer equity and built his own platforms when gatekeepers tried to limit his upside.

It’s why he launched TIDAL, invested in startups early, and kept control of his masters. The goal wasn’t just to make money—it was to build something no one could take from him.

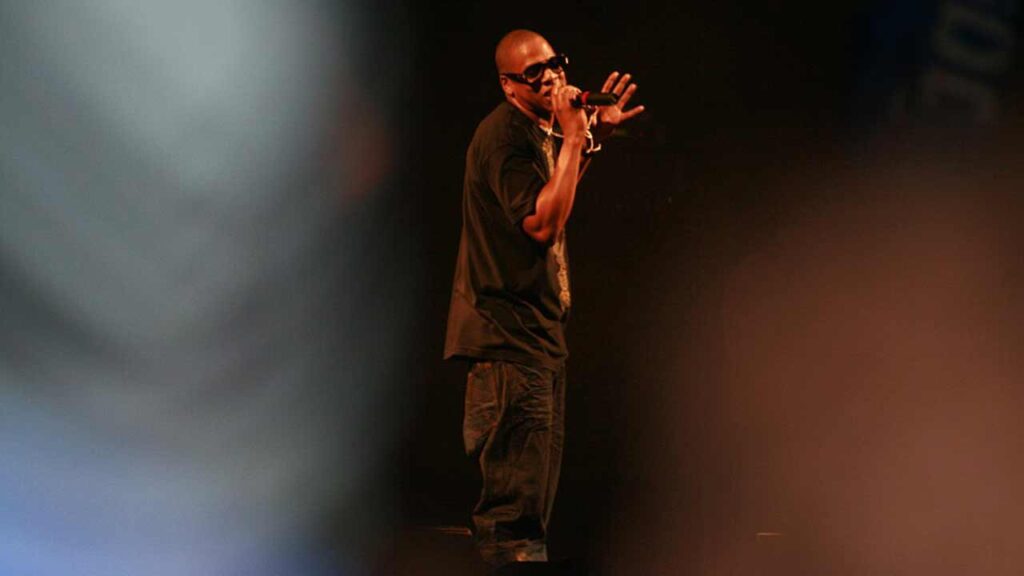

He Leveraged Cultural Relevance into Deal Flow

Jay-Z’s influence opened doors, but it was his strategy that turned access into ownership. As his brand grew, companies wanted in. He used that attention to secure equity in tech, consumer brands, and real estate.

He’s backed companies like Uber, Sweetgreen, and Impossible Foods—not as a celebrity investor, but as a long-term player. It’s not about quick flips. It’s about long-term stakes that build real wealth.

He Built a Portfolio, Not Just a Brand

Today, Jay-Z’s net worth is estimated at over $2.5 billion. That includes stakes in liquor brands, entertainment companies, art, and VC funds. His wealth didn’t come from one hit—it came from stacking assets that keep paying over time.

Each move added a new layer: music funded the first ventures, clothing scaled it, liquor exploded the margins, and tech investments gave him long-term upside. It’s a portfolio built with intention—not luck.

The Bottom Line

Jay-Z didn’t become a billionaire by staying in the studio. He turned one album into an empire by treating his career like a business from day one. Ownership, strategy, and patience turned his early moves into generational wealth. And for anyone building their own path, it’s a reminder: one product can spark it all—if you use it right.

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.