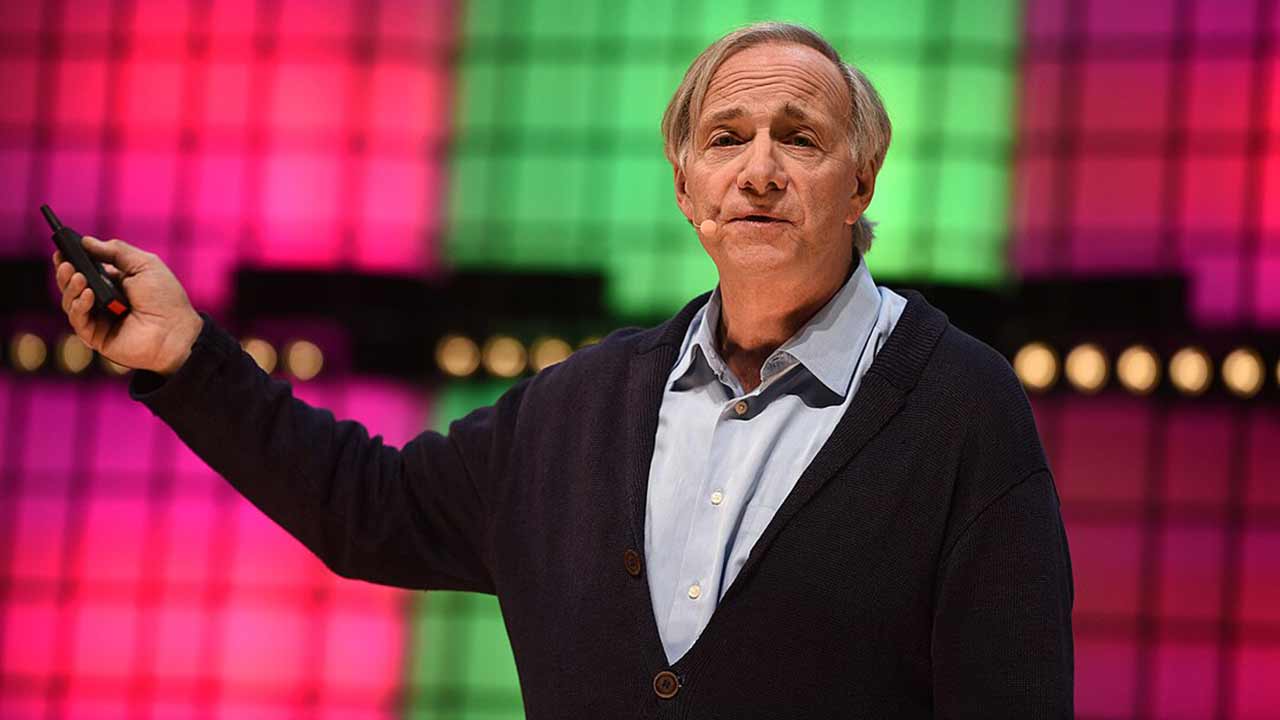

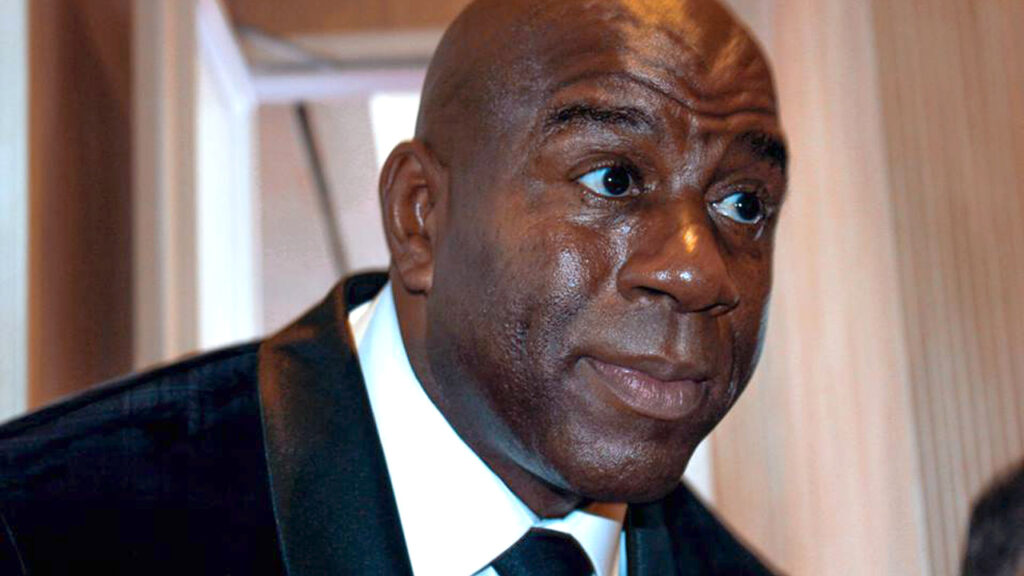

Magic Johnson’s success didn’t stop at the basketball court. After retiring from the NBA, he became a powerhouse in business, growing his net worth to over $1 billion. But if you ask him what it takes to build real wealth, he’ll tell you it’s not just about stacking money for yourself. His mindset is bigger than that—and it’s one that anyone trying to grow their finances should pay attention to.

Think Beyond Personal Gain

One of the biggest takeaways from Magic Johnson’s business playbook is this: if you want to build something lasting, you can’t make it all about you. He’s always thinking about how his work can create opportunities for others—whether it’s through hiring in underserved communities or investing in places that often get overlooked.

That mindset gives you a much deeper reason to push forward. When your goals are tied to helping others—your family, your community, or people who remind you of where you came from—it changes the way you operate. You’re not just chasing money; you’re building something that matters.

Keep Your Motivations Visible

It’s easy to get distracted when life gets busy or things feel overwhelming. That’s why Magic Johnson believes it’s important to keep your “why” front and center. He literally keeps reminders around his home to stay locked in on what’s important. [247wallst]

You don’t need anything fancy—just something that keeps your goals top of mind. A sticky note, a photo, a saved voice memo. The point is to stay grounded in what’s driving you. When that reminder is right in front of you, it’s a lot harder to lose focus.

Evaluate Your Spending Habits

Magic didn’t become a billionaire by blowing through money. He talks about being intentional with spending and knowing when to hold back. A simple habit like waiting 30 days before buying something non-essential can go a long way.

This kind of discipline adds up fast. The less you waste, the more you can invest into things that actually build wealth—whether that’s a business, real estate, or your retirement accounts. Small habits around spending can change your whole financial future.

Seek Knowledge and Partnerships

Magic didn’t pretend to know everything—he went out and learned. He spent time around business leaders, soaked up information, and leaned on mentors who had been through it before. That curiosity is a huge part of what made his transition from athlete to entrepreneur so smooth. [Wikipedia]

If you’re trying to build wealth, you need to do the same. Read, listen, ask questions, and build relationships with people who are ahead of you. The right connection or piece of advice can shortcut years of trial and error.

Diversify Your Investments

rom movie theaters to Starbucks locations to sports teams, Magic’s portfolio is all over the map. That’s not by accident. Diversifying helped him stay stable even when one area of business slowed down. [Moneywise]

For regular people, the concept still applies. Don’t rely on a single income stream. Spread out your investments—stocks, real estate, a side hustle—whatever makes sense for your goals and risk level. The more you diversify, the more protection and upside you give yourself.

Final Thoughts

Magic Johnson didn’t just get rich—he built wealth that impacts entire communities. His mindset proves that success isn’t just about what you take in; it’s about what you give back. By thinking bigger, staying focused, managing your money wisely, and surrounding yourself with the right people, you can start building your own version of lasting wealth—just like he did.

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.