With high interest rates, tight inventory, and rising down payments, buying a home in 2025 feels out of reach for a lot of first-time buyers. But a new push from HUD is starting to shift that. It’s not getting much attention yet—but it could be one of the biggest tools for unlocking homeownership in the next few years.

The program is called **The HUD 203(k) Limited Loan**, and while it’s technically been around, recent updates and incentives are making it way more accessible for buyers who want to get in without waiting for the “perfect” house—or the perfect market.

It Helps Buyers Finance Repairs Into the Loan

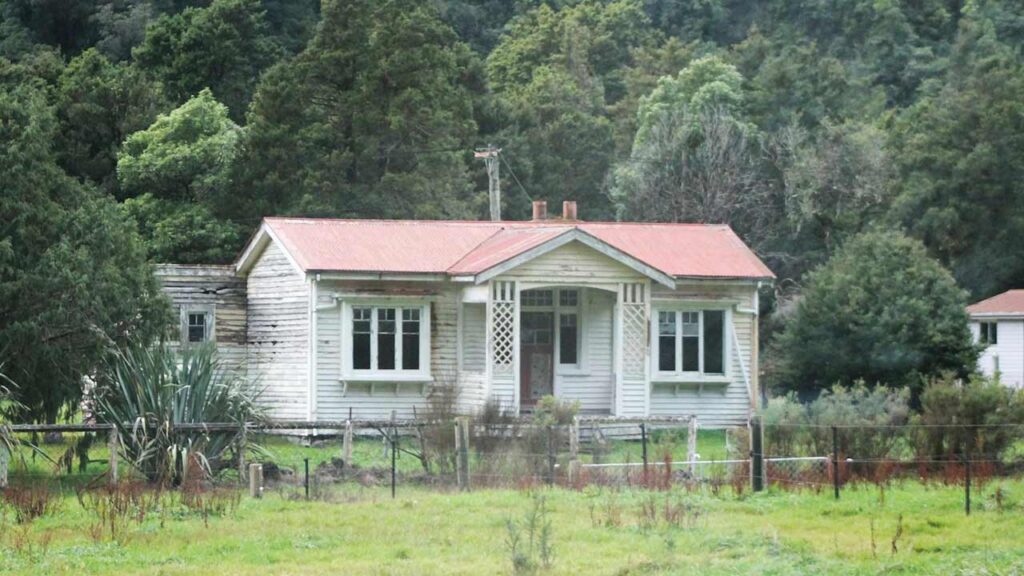

One of the biggest hurdles for entry-level buyers is finding a move-in-ready home they can actually afford. The 203(k) Limited program solves that by allowing buyers to roll up to $35,000 in repairs into their mortgage—so they can buy the fixer-upper and fund the renovation with one loan.

This means buyers can skip over the overpriced turnkey listings and start looking at properties that need cosmetic work, new roofs, or system upgrades. And instead of scrambling for cash post-close, the money’s already built into the financing.

Down Payment Requirements Stay Low

Just like a standard FHA loan, the 203(k) Limited requires as little as 3.5% down. That’s a game-changer for buyers who’ve been saving but still fall short of conventional loan thresholds. Combine that with seller concessions or closing cost assistance, and the total cash to close drops even further.

Some states and local governments are also layering in grant programs or down payment assistance that can stack with 203(k) financing—making homeownership possible with less out-of-pocket than most people expect.

It Opens Up a Whole New Inventory Tier

Most buyers skip homes that need work because they’re worried about the renovation budget. But this program flips that thinking. Properties that sat stale on the market due to outdated kitchens or worn-out floors now become opportunities—not problems.

That unlocks a wider pool of listings and gives buyers a competitive edge in markets where turnkey homes still trigger bidding wars. With a 203(k), you don’t need to win the prettiest house—you just need the right bones and a smart contractor.

The Application Process Is Simpler Than It Used to Be

In the past, 203(k) loans had a reputation for being complicated and slow. That’s changing. Lenders have streamlined the process, and the “Limited” version of the loan avoids most of the red tape tied to full rehabs. There’s no HUD consultant required, and contractors are now easier to work with under the new guidelines.

Buyers still need to be organized, but it’s nothing a good lender and agent team can’t handle. And in exchange, you get a fully renovated home—funded from day one.

It’s Not Just for Single-Family Homes

Another benefit most people overlook? The 203(k) Limited loan can be used on two- to four-unit properties, as long as the buyer plans to live in one of them. That opens the door to house hacking—buying a duplex, living in one side, and renting the other to offset the mortgage.

In a tight rental market, that strategy makes even more sense. And with renovation costs included in the loan, buyers can upgrade both units from day one without draining savings.

This Is a Strategy Play

The 203(k) Limited loan isn’t just about buying a house—it’s about buying smart. It gives buyers the flexibility to look at more properties, the financing to make repairs upfront, and the leverage to build equity from the start.

With the right property and a plan, this HUD-backed program could be the key that turns “someday” into “right now.”

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.