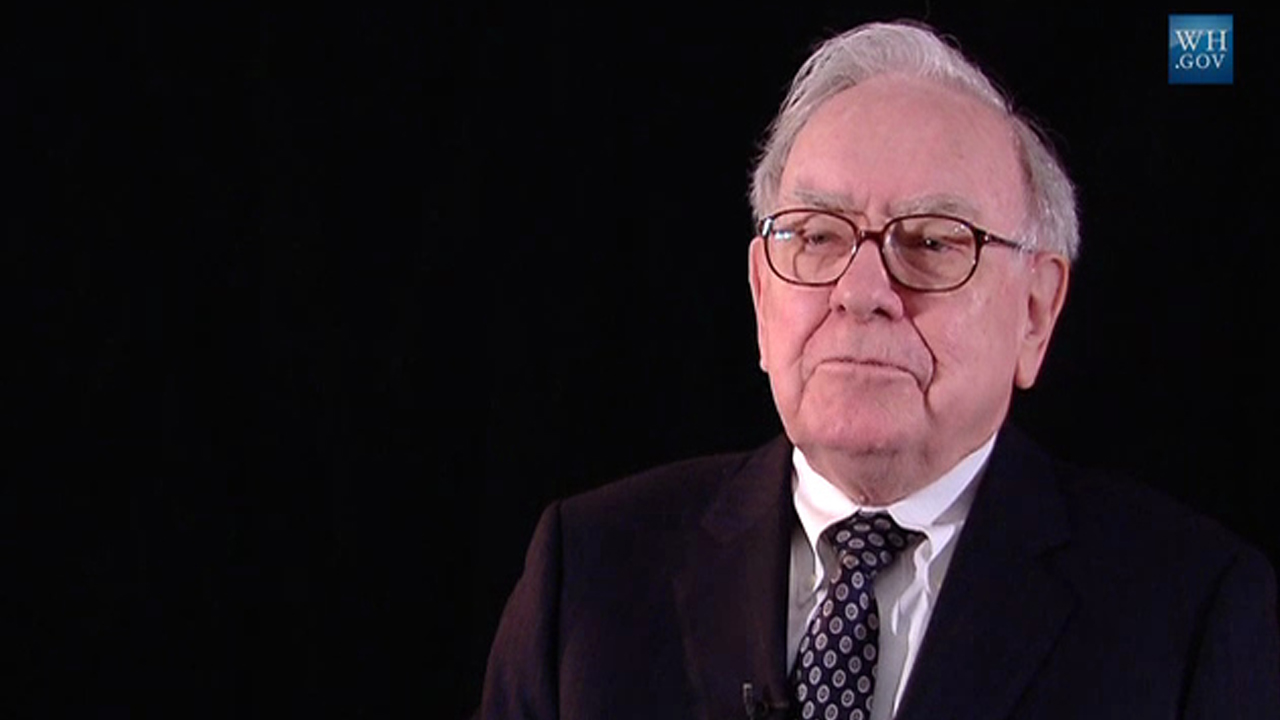

Warren Buffett, the veteran leader of Berkshire Hathaway, has long been a figure of fascination for investors, his track record a testament to decades of astute financial decisions. Since taking the helm 60 years ago, he has steered the company’s Class A shares to a staggering return of over 6,340,000% as of March 18, dwarfing the S&P 500’s 37,300% gain, including dividends, over the same period. Yet today, with Berkshire sitting on a record $334.2 billion in cash, cash equivalents, and U.S. Treasuries, Buffett appears to be holding back. For more than two years, he has been a net seller of stocks, a move that underscores a cornerstone of his investment philosophy: a steadfast commitment to value (Source: The Times).

A Cash Pile Grows as Stock Sales Mount

By the close of 2024, Berkshire Hathaway’s cash reserves reached an unprecedented $334.2 billion, a sum that offers remarkable financial leeway for a company of its stature. Recent filings reveal some targeted purchases—small increases in stakes in Japan’s five major trading houses (Mitsubishi, Itochu, Mitsui, Sumitomo, and Marubeni), as well as selective buys in Sirius XM Holdings, Occidental Petroleum, and VeriSign. Buffett has secured an agreement to potentially lift Berkshire’s ownership in the Japanese firms beyond 10%, signaling a measured confidence in those holdings (Source: Investopedia).

Yet these moves belie a broader trend. For nine consecutive quarters, Buffett has sold more stocks than he has bought, offloading a net $173 billion worth since October 2022. This persistent selling has swelled Berkshire’s cash position to its current peak. Notably absent from his recent activity is any repurchase of Berkshire’s own shares, a practice he once embraced enthusiastically. From July 2018 to June 2024, he authorized nearly $78 billion in buybacks over 24 straight quarters, only to halt entirely in the second half of 2024 (Source: Business Insider).

The Unyielding Pursuit of Value

At the heart of Buffett’s approach is a focus on acquiring strong companies at prices that reflect their true worth—a philosophy distilled in his oft-quoted 2008 letter to shareholders: “Price is what you pay; value is what you get.” Borrowed from his mentor Ben Graham, this maxim has guided Buffett through market booms and busts. He has occasionally bent his own rules, but his insistence on fair valuations remains absolute. When prices soar beyond what he deems reasonable, he waits.

That patience is evident now. The so-called Buffett Indicator—the ratio of total U.S. market capitalization to GDP—offers a clue to his restraint. Buffett once called it “probably the best single measure” of market valuations. Historically, it has averaged 85% since 1970, meaning the value of all public companies equals 85% of GDP. But just before the S&P 500 hit its all-time high, the indicator spiked to 207.33%, a level far exceeding its long-term norm (Source: Current Market Valuation).

Berkshire’s own stock mirrors this caution. On March 18, its Class A shares traded at a 74% premium to book value. In prior years, Buffett readily repurchased shares at premiums of 20% to 50%, but at 50% to 80%, he has chosen to abstain. The message is clear: even his own company, a perennial favorite, no longer meets his threshold for value (Source: YCharts).

A Strategy Tested by Market Highs

Buffett’s cash hoard and net-selling streak have raised eyebrows among investors who expect Berkshire to deploy its capital aggressively. After all, a company built on investment typically thrives by putting money to work, not letting it sit. Yet his recent actions—or lack thereof—reflect a disciplined adherence to principle over pressure. Despite a correction in the S&P 500 and Nasdaq Composite this month, Buffett remains selective, adding modestly to existing positions rather than diving into new opportunities.

This restraint may frustrate those eager for action, but it aligns with a career defined by waiting for the right moment. Until stock prices, including Berkshire’s, fall to levels that offer what he sees as fair value, Buffett seems content to let his $334.2 billion pile grow. For now, his legacy as a value investor holds firm, unshaken by a market that tests even the most patient among us.

Alexander Clark is a financial writer with a knack for breaking down complex market trends and economic shifts. As a contributor to The Daily Overview, he offers readers clear, insightful analysis on everything from market movements to personal finance strategies. With a keen eye for detail and a passion for keeping up with the fast-paced world of finance, Alexander strives to make financial news accessible and engaging for everyone.